UK Gender Wealth Gap: Men may hold more than £125,000 than women by retirement – but can savvy female savers overtake men at Raisin UK?

For the first time, the savings account platform Raisin UK is publishing figures on the differences between women’s and men’s savings. In March 2023, savings platform Raisin reached a significant milestone: one million people worldwide now use Raisin (which includes the UK platform Raisin UK) – that’s one million people taking control of their financial futures! But how are men and women saving differently?

Raisin UK found:

- Male savers hold 7.4% more cash in easy access savings accounts than women

- Male and female savers equally favour a 1 year fixed term bond over any other term length – but men hold 6.1% more in savings in this account type than women

- Female savers aged between 18-29 start off with more money in fixed rate bonds than men – but then drop behind male savers from ages 30 – 79

- Male savers open 3 year fixed rate bonds with a deposit that is nearly 30% larger than female savers

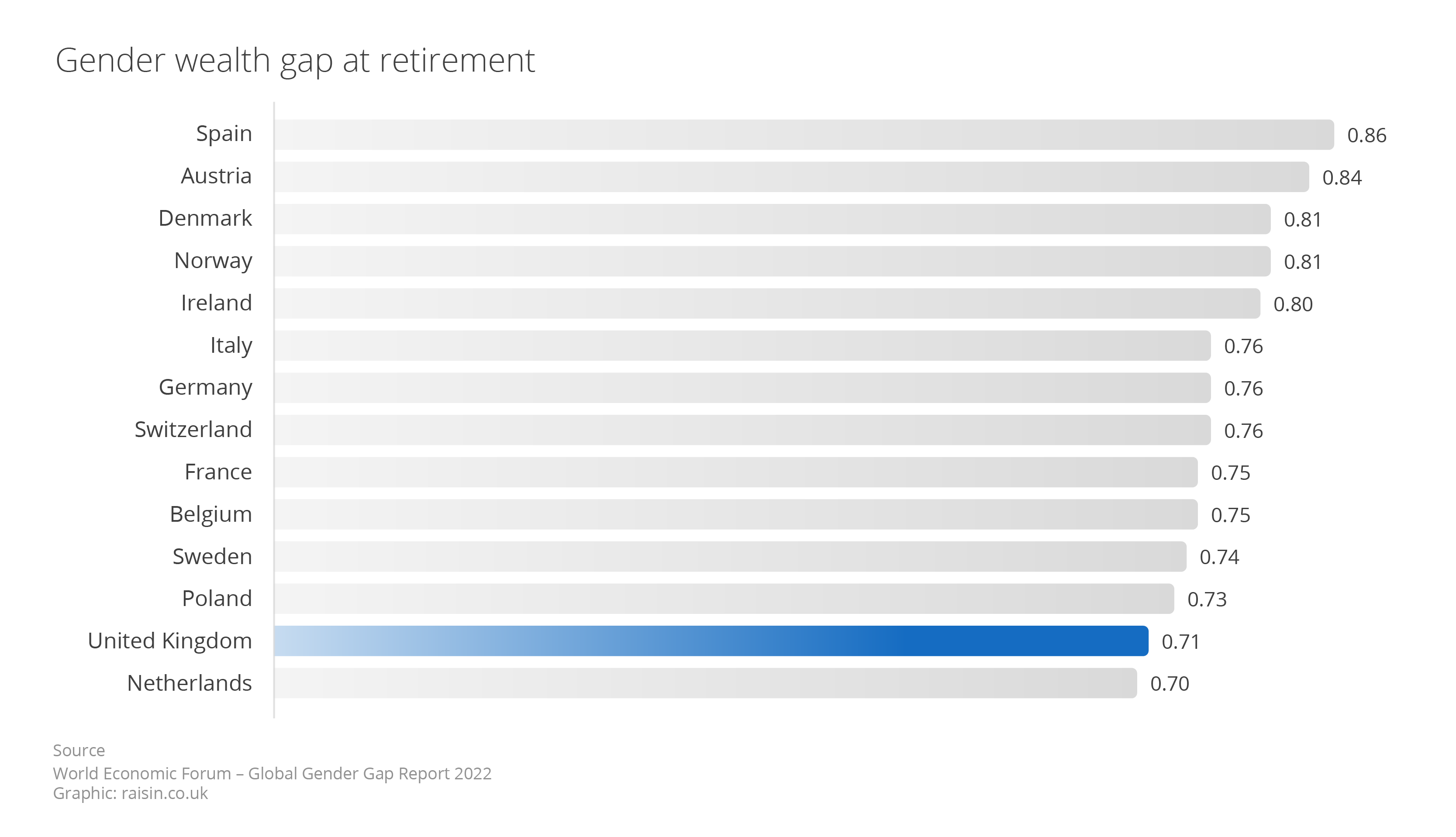

By now, we’ve all heard about the gender pay gap, but don’t be fooled – it remains as relevant as ever in 2023. Although the disparity between the amount of income earned by men and women has been slowly declining over time, ONS data* recorded that the pay gap in the UK actually increased in 2022 (to 8.3%), whilst in the Global Gender Wealth Equity Report of the same year, the UK scored the second-worst out of 14 European countries in the Wealth Equity Index.

Of course, this difference in income doesn’t just affect day-to-day living: a recent study by money.co.uk** showed that women save more than a third less (34.5%) than their male counterparts, and as a result, must save more than £125,067 by 65 in order to close the gap in terms of overall pension pot.

With the average Raisin UK customer, at 61, just a few years ahead of this, we took a deep dive into exactly how our customers save, whether savings behaviour differs between men and women, and how women can close the gap when it comes to savings.

On first glance, Raisin UK boasts a fairly equal split when it comes to customers: 51% of our savers are women, compared to only 38% and 27%, respectively, on our Raisin Germany (Weltsparen) and Raisin Netherlands platforms.

When it comes to the type of savings accounts men and women are opting for, this equal split continues: 55% of our male customers have at least one fixed rate bond, with 52% of women also taking advantage of a competitive 12 month fixed rate on their money.

The difference is more stark when we look at easy access savings accounts. Here, only 45% of women currently have a flexible savings account open, compared to 55% of our male customers, suggesting female savers could be less inclined to open a savings account for money they want to be able to access easily. Indeed, previous Raisin UK research revealed that almost half of Brits don’t even hold a savings account, instead keeping their money in a low or zero-paying current account.

But, of course, the gender savings gap comes into play when it comes to the amount both men and women are saving in these savings accounts.

In easy access savings accounts, men hold 8.4% more in savings than women in the 40-49 age group, rising to a difference of 11.6% by the time we reach the 60-69 age category. This adds up to a big difference in savings between retirement-age men and women, showing that small savings over time can lead to more significant savings, and in the long run, they can grow into a substantial amount of money.

Whilst in fixed term products, this disparity continues: male savers not only hold more fixed term savings accounts per person than female savers, but their average total amount held in fixed rate bonds is 6.8% higher than that of women. Of savers in the 40-49 age group with a three year fixed rate bond, male savers open their account with a deposit that is 28.9% larger than the average female saver opening the same account.

Raisin financial expert, Katharina Lüth, commented: “The lower pay of women throughout their working lives compared to men leads to the so-called Gender Lifetime Earnings Gap, which can become a major problem in old age and even lead to poverty in old age. Women often have to take pay cuts due to family leave to raise or care for children or due to part-time work and therefore pay lower contributions into the statutory pension fund, which will often not be enough to maintain the accustomed standard of living later on in retirement.This makes it all the more important for women to take their finances into their own hands early on and make private provisions for old age.”

Data correct as of 03/04/23

*https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/bulletins/genderpaygapintheuk/2022

**https://www.money.co.uk/savings-accounts

***https://www.statista.com/statistics/281684/life-expectancy-in-the-uk-by-gender-and-country/#:~:text=In%202020%2C%20the%20life%20expectancy,where%20it%20was%2076.79%20years

United States

United States

Germany

Germany

Spain

Spain

United Kingdom

United Kingdom

Netherlands

Netherlands

Austria

Austria

France

France

Ireland

Ireland

Poland

Poland

Other (EU)

Other (EU)