How to open a savings account with Raisin UK

In this guide, you’ll find all that you need to know about opening savings accounts via our marketplace from our partner banks.

To open any savings account through our marketplace, you need to apply and be approved for a Raisin UK Account. You can start applying for savings accounts from our partner banks as soon as you submit your registration, but we recommend waiting until you receive an email confirming that your Raisin UK Account has been fully opened. You can only fund savings accounts once your Raisin UK Account has been fully approved.

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

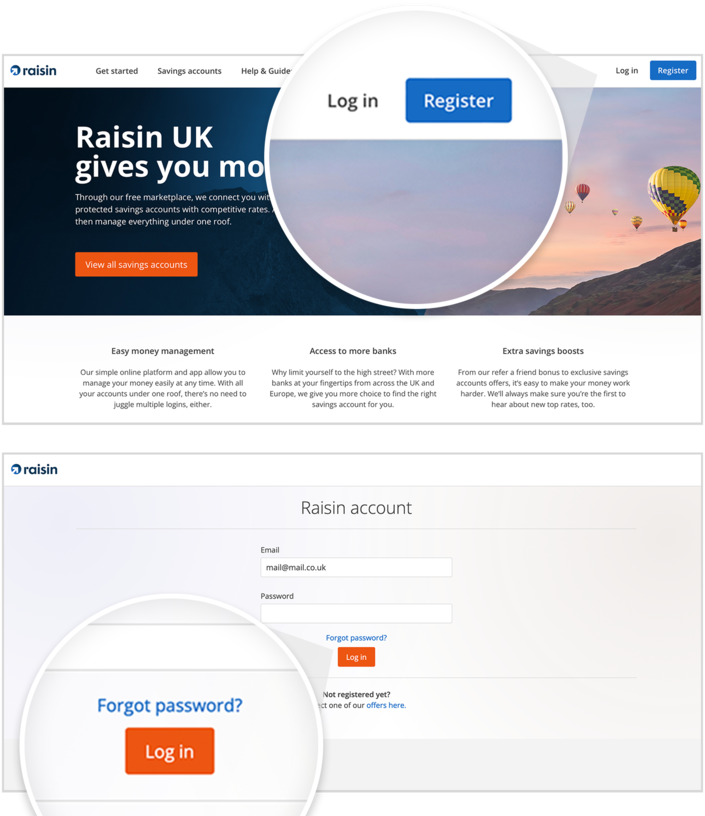

1. Register for a Raisin UK Account and log in

To apply for, fund and manage all savings accounts available through our marketplace, you need to register for a Raisin UK Account.

Once you’ve registered for a Raisin UK Account, log in by visiting any page on raisin.co.uk and clicking the ‘Log in’ button in the top right corner.

Please be aware that until your Raisin UK Account application is approved, you can only apply for savings accounts. When your Transaction Account sort code and account number are displayed in the top right-hand corner of your Raisin UK Account, you can transfer your money and complete your savings account application.

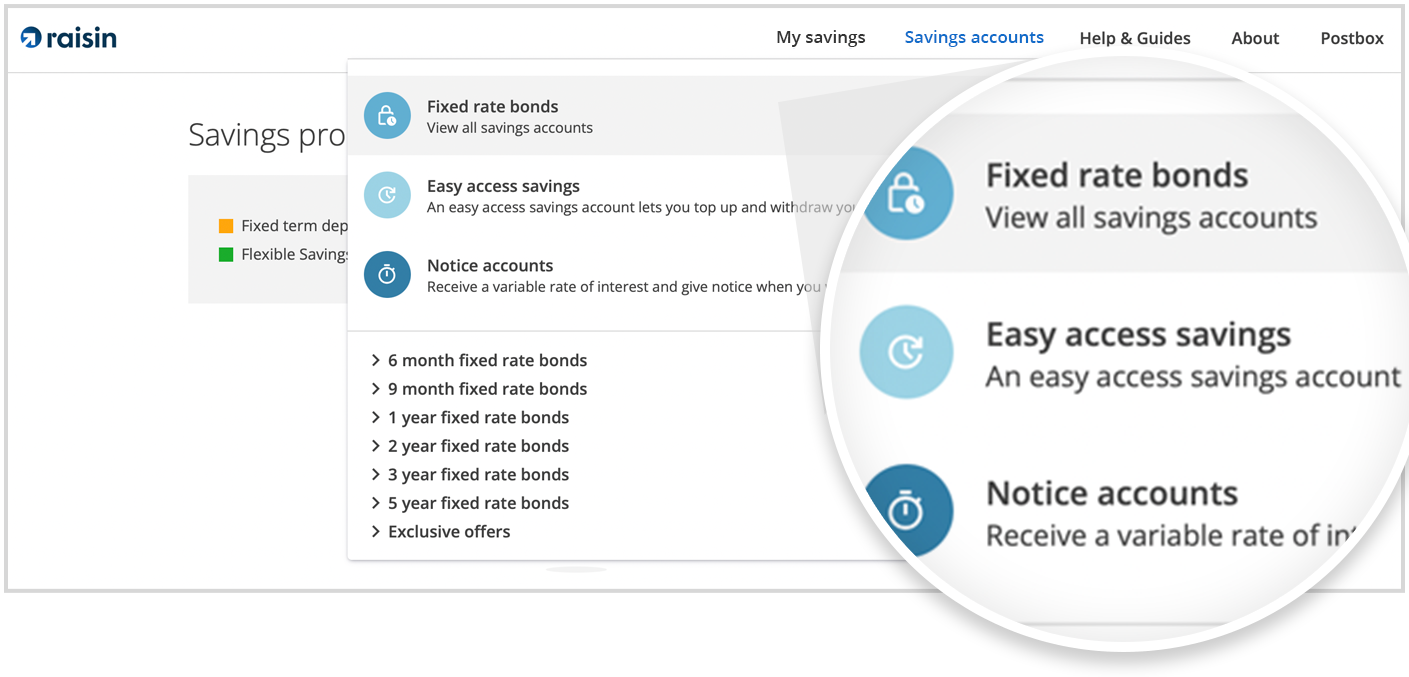

2. Navigate to ‘Savings accounts’

When you log into your Raisin UK Account, the first page you’ll see is your dashboard. From here, navigate to ‘Savings accounts’ and click on any of the options below (for example ‘Fixed rate bonds), to view all available savings accounts.

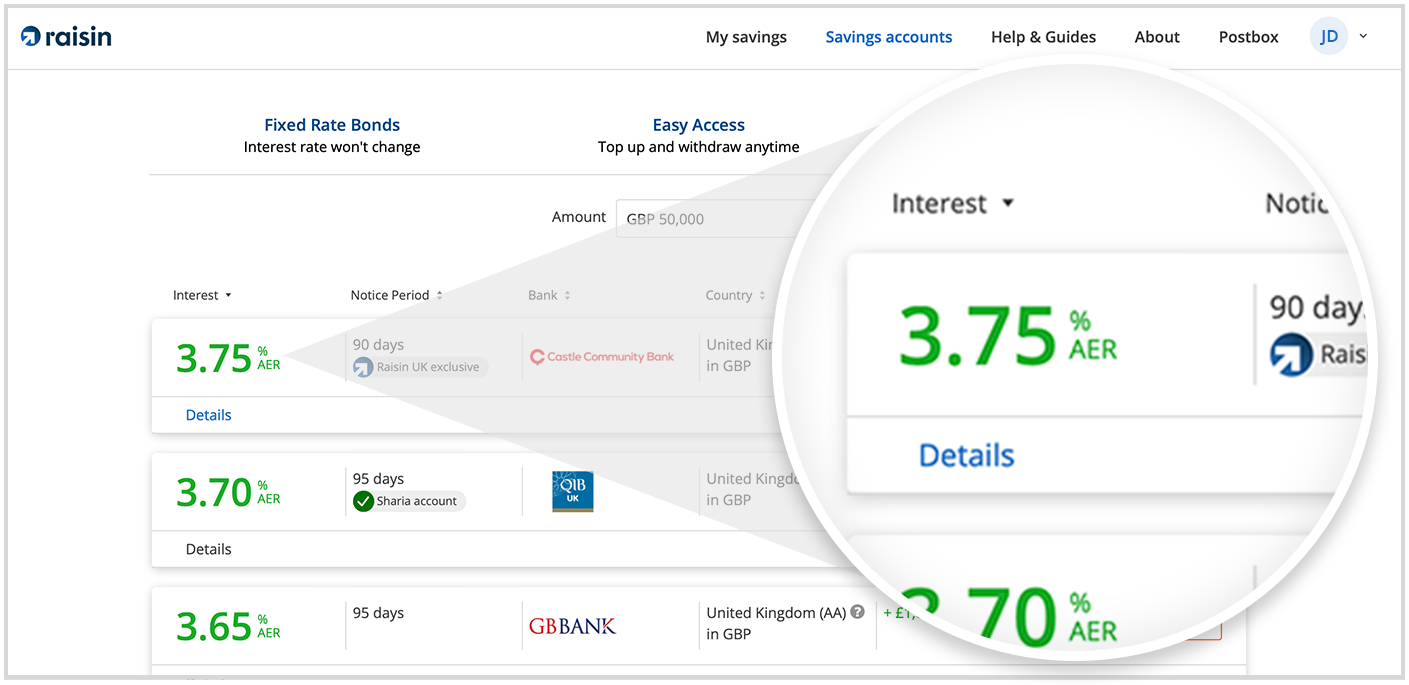

3. Find the savings account you want to open

Click on the relevant tab for the type of savings account you’re interested in, e.g. an easy access account, notice account or fixed rate bond. Once you’ve selected the appropriate tab, scroll down and click on the particular account that you want to apply for.

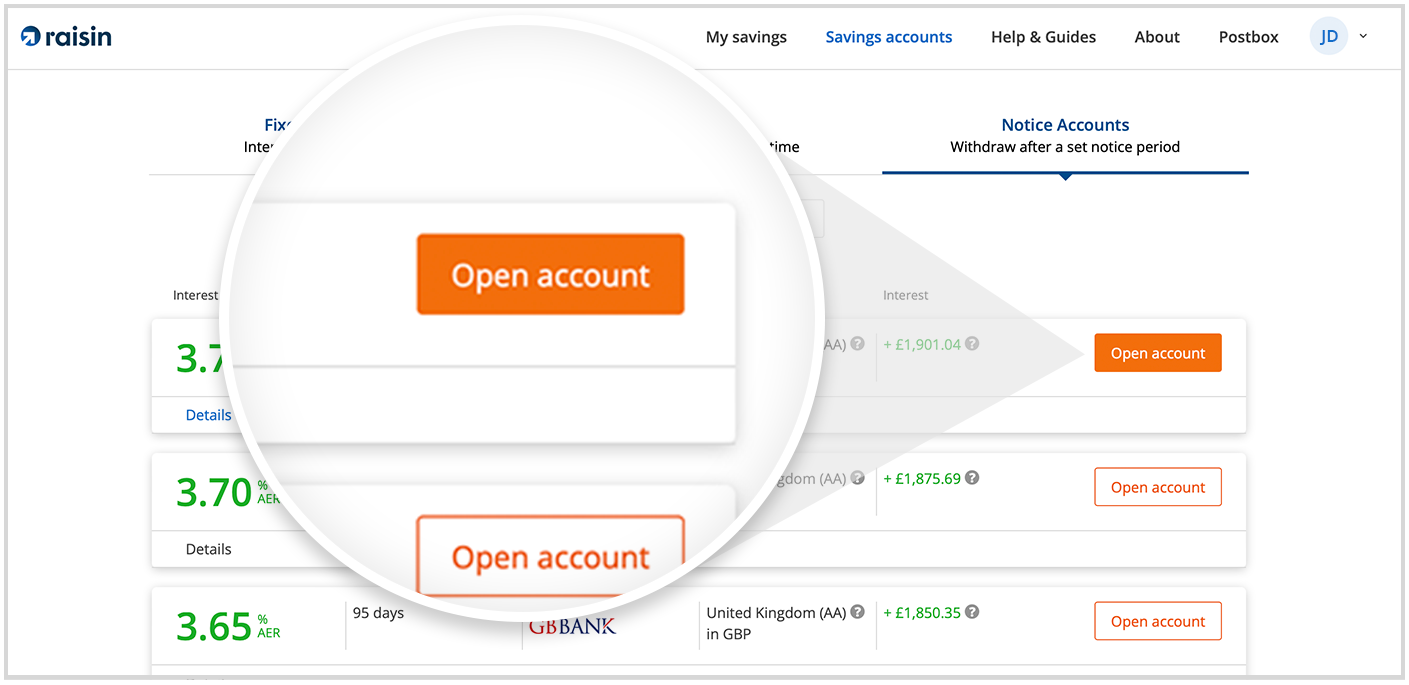

4. Confirm you’re happy with the details and rate then click ‘Open account’

By clicking the ‘Details’ tab of any savings account on our marketplace, you can view important information about the bank, the rate of the savings account, the withdrawal and top-up process (if applicable), how interest is paid and more.

Once you’re satisfied with the details, you can click ‘Open account’ to start your application.

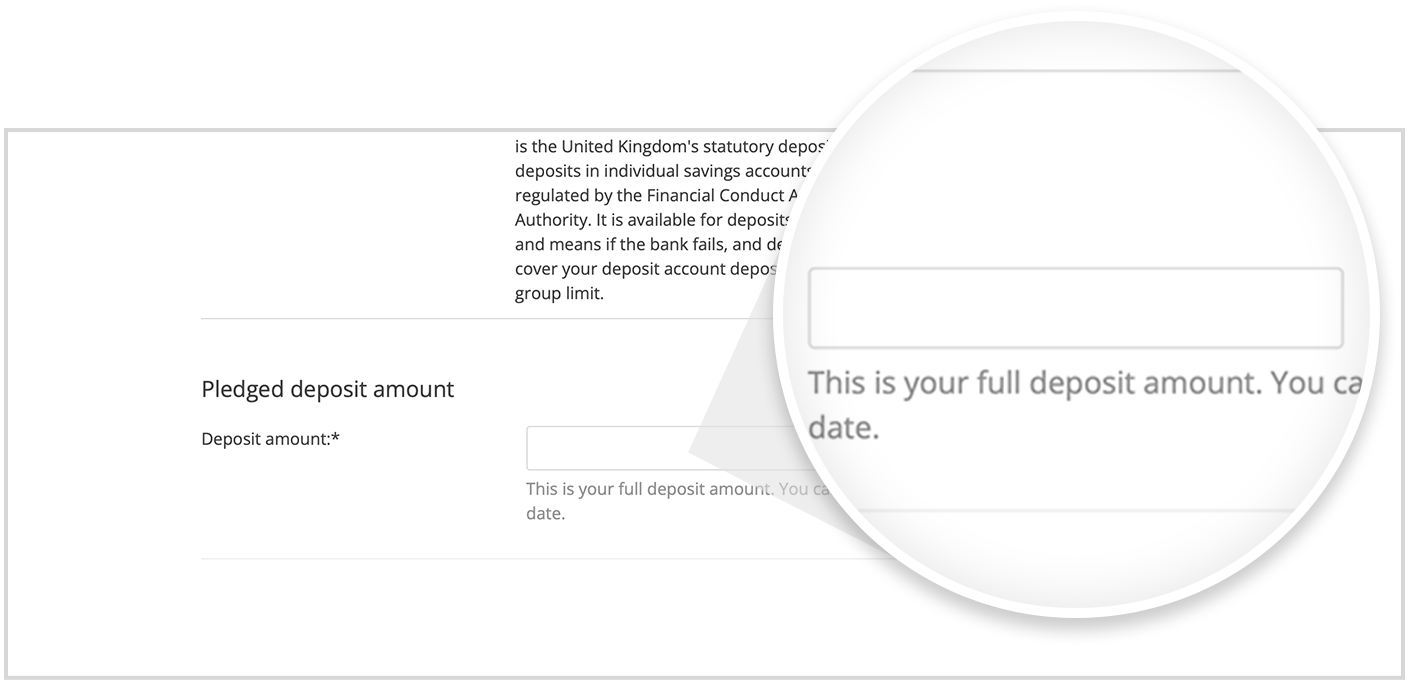

5. Enter the amount you want to open your account with

After clicking ‘Open account’, you’ll be shown the details of the savings account you’re applying for.

If you’re applying for an easy access savings account, you’ll need to enter the amount you want to open your account with. Please be aware that the minimum and maximum deposit amount isn’t the same for every account, so it’s important to make sure that your opening deposit is within the permitted limits. The minimum and maximum deposit amounts are explained in the ‘Details’ section. If you’re applying for a fixed rate bond, you should enter the full ‘Pledged deposit amount‘ that you want to open this account with. Please be aware that you cannot change your deposit amount, so be sure to enter the right amount.*

*If you enter an incorrect deposit amount but have yet to transfer your deposit to your Transaction Account, you can withdraw your application and reapply if the savings account is still available. You can do this through your Raisin UK Account by clicking ‘My savings’ in the navigation menu, then click ‘Details’ on the application you want to withdraw, and then click ‘Withdraw application’. Confirm that this is the application that you want to withdraw by clicking ‘Withdraw application’ and you will see a message confirming that your application has been cancelled. Follow step 2 of this guide onwards to reapply if the savings account is still available.

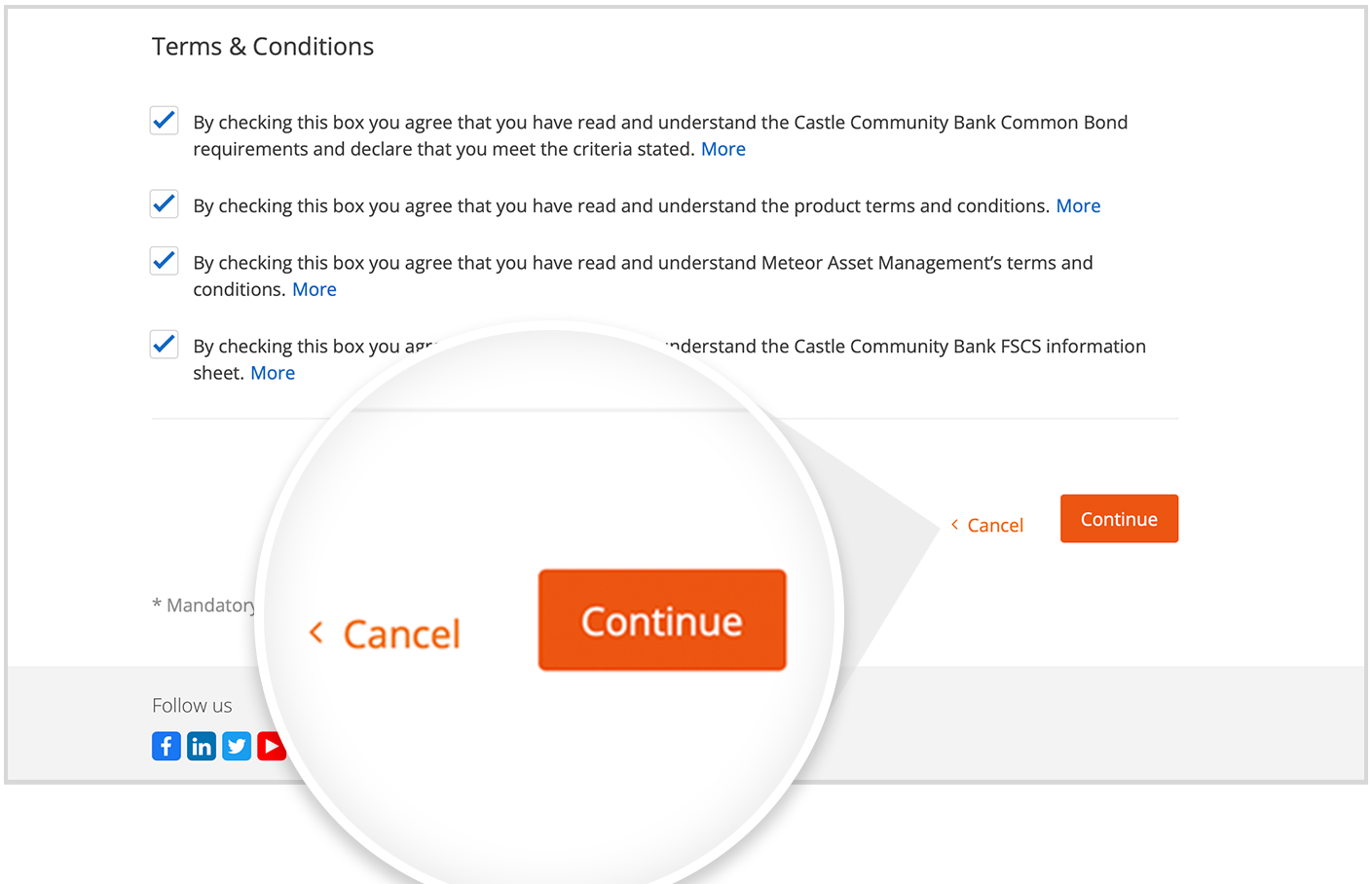

6. Agree to the terms and conditions

To continue with your application, please read the terms and conditions for your chosen savings account. You can confirm you’ve read these terms and conditions by clicking the tick boxes.

Once you have accepted all of the terms and conditions, click ‘Continue’ to proceed with your application.

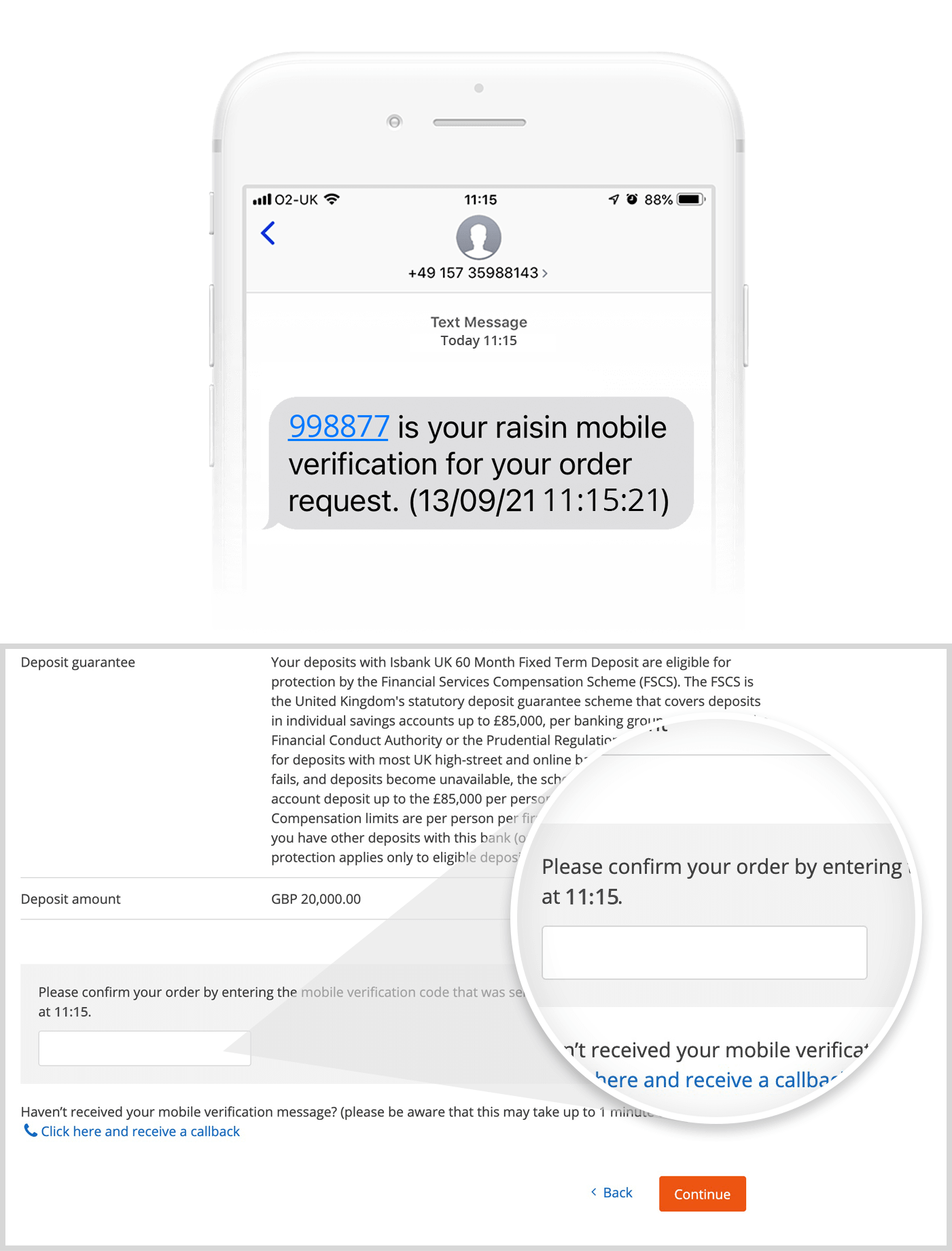

7. Verify your application

Enter the six-digit mobile verification number we send to your mobile phone as an SMS text message and click ‘Continue’ to submit your application.

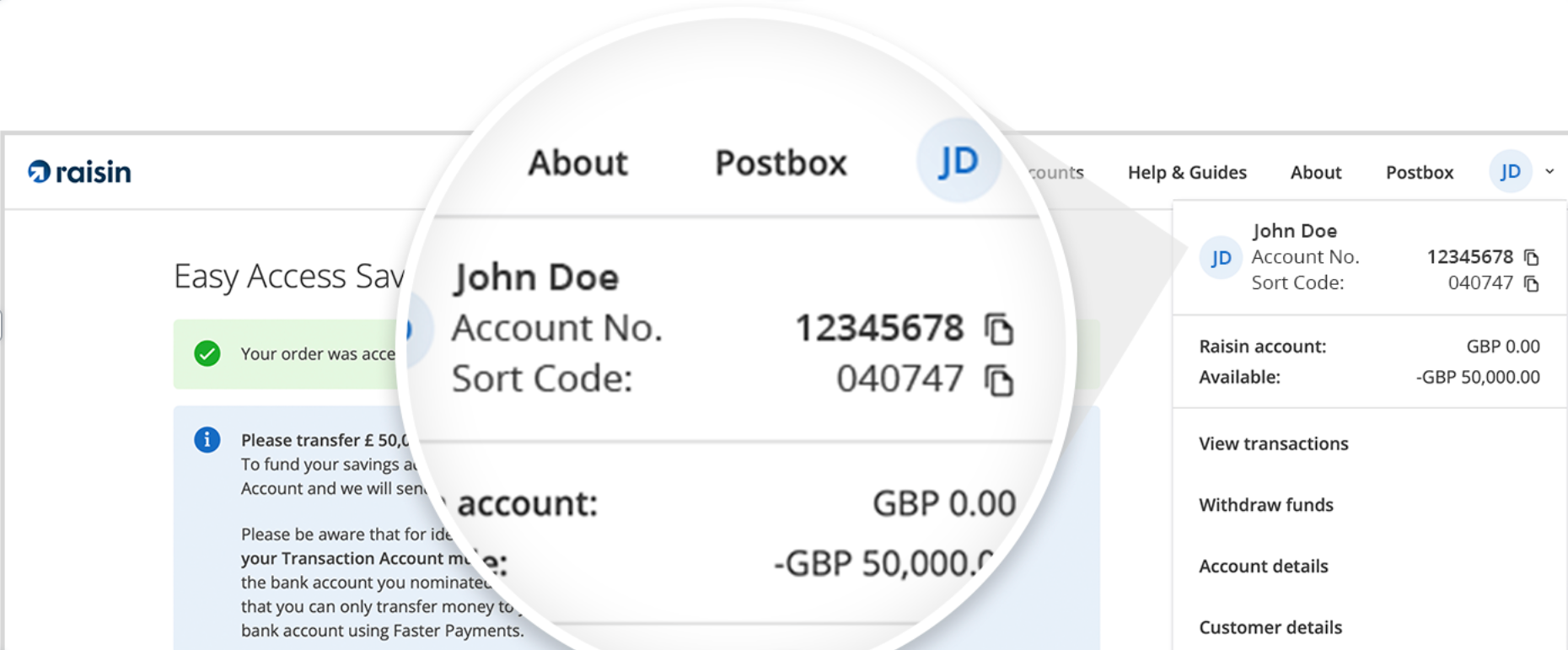

8. Transfer your deposit to your Transaction Account

Transfer your full deposit amount in as many transactions as you want using Faster Payments to your Transaction Account. You can find your Transaction Account details on the top right of the dashboard of your Raisin UK Account when you log in and hover over your initials. Please be aware that you’ll need to fund your account within the specified funding window (typically 60 days).

You can only fund your Transaction Account from your Nominated Account. Any pay-ins from another account will be automatically returned according to your bank’s normal processing times.

When transferring funds from your nominated bank or building society account, in the payee information you should enter your name as it appears in your Raisin UK Account, e.g. Joe Bloggs. Money transferred into your Transaction Account typically shows as available straight away.

Step 9: We’ll review your application

When the full amount that you want to deposit is available in your Transaction Account, your application will be reviewed. We’ll contact you once the partner bank has reviewed your application.

It typically takes less than two business days to open a savings account through our marketplace once your full deposit amount is available in your Transaction Account.

Note: The deposit amount(s) you transfer from your linked account should match the ‘Amount to be transferred’ displayed at the top of your Raisin UK Account.

Some things to keep in mind

You might find the following information about applying for a savings account at raisin.co.uk useful:

Additional information

You may need to provide additional identification, such as a scan of your passport when applying for some savings accounts. We will let you know if this is the case.

Funding window

You have a funding window (typically 60 days) within which to fund a fixed rate bond through our marketplace. You don’t have to transfer your full deposit amount to your Transaction Account in one go, but if you don’t transfer the full amount you asked to deposit within the funding window, your application will be cancelled and any funds you’ve transferred will remain in your Transaction Account.

Amending your application

You can’t change the deposit amount you entered when applying for a savings account once you’ve applied, but you can withdraw your application and start a new one with a different deposit amount. Please be aware that once you’ve transferred the full deposit amount, your application will be sent to the partner bank. Once a fixed rate bond savings account has been sent to a partner bank for review, you cannot cancel your application or close your savings account unless there are exceptional circumstances, as explained in our terms and conditions.

Want to know more?

Have you found the information that you’re looking for? Please read our FAQs, where you will find further information, or read more of our guides.