2 year fixed rate bonds

✓ 2 year fixed rate bonds at Raisin UK up to 4.32% AER

✓ Earn a competitive fixed interest rate for two years

✓ Lock away a single lump sum and watch it grow

Home › Savings accounts › Fixed rate bonds › 2 year fixed rate bonds

View and compare top 2 year fixed rate bonds

Competitive interest: A 2 year fixed rate bond pays a competitive fixed interest rate that’s typically higher than what you would earn from an ISA or easy access account

Lump sum: In exchange for a higher interest rate, you’ll need to lock away a lump sum for two years, during which time you won’t be able to ‘top up’ or withdraw from your initial deposit

Deposit protection: All of the 2 year fixed rate bonds available through our marketplace are protected under the Financial Services Compensation Scheme (or its European equivalent)

How much can I earn from a 2 year fixed rate bond?

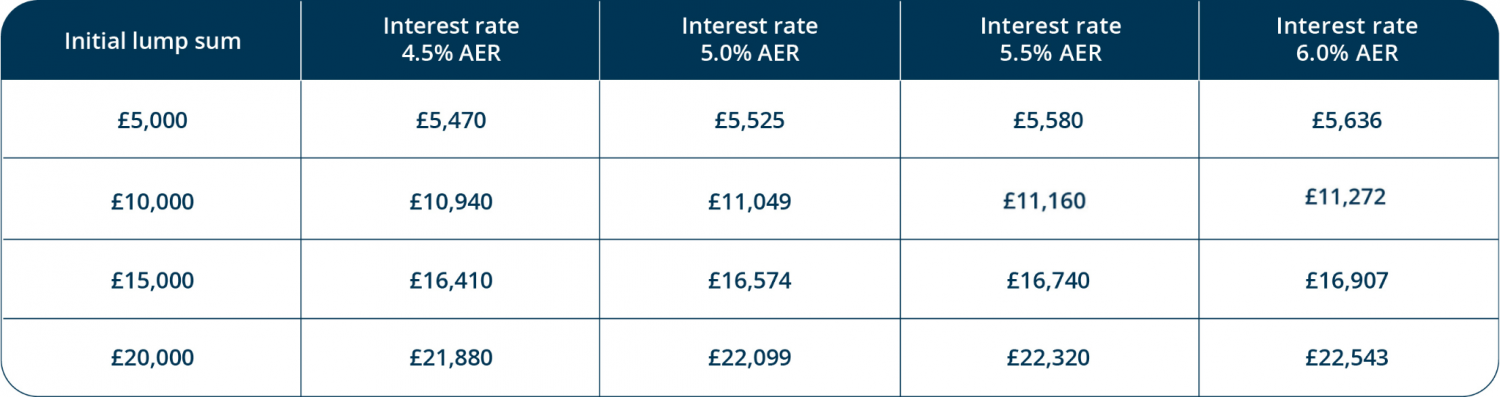

The amount you can earn with a 2 year fixed rate bond depends on the interest rate on the savings account, and how much you can deposit. The below table illustrates how much you could grow your initial deposit over a two year term with different savings amounts at different AERs.

*Rates are for illustrative purposes only and are not related to actual savings accounts from the Raisin UK marketplace.

What is a 2 year fixed rate bond?

A 2 year fixed rate bond savings account allows you to fix the interest rate you earn for 24 months, regardless of whether the Bank of England changes the base interest rate. You can open a 2 year fixed rate bond with one lump-sum deposit, which you can make with multiple transfers at Raisin UK. Once your savings account is open, you can’t make any further deposits or withdraw your money for 24 months.

It’s a simple way of ensuring you get the results you want from your savings in the medium-term, as you’re locked in for two years. If locking your money away for two years doesn’t sound right for you, fixed rate bonds are also available in six month, one year, three year and five year terms, or you could consider more flexible savings accounts, like easy access and notice accounts. Simply choose the savings account that best suits your goals.

Is a 2 year fixed rate bond the same as a 2 year savings bond?

Yes. This type of savings account goes by several different names, all of which mean the same thing. You may hear of a fixed rate bond called a fixed term deposit, fixed rate savings, fixed term savings, savings bonds or a fixed rate savings account, too.

How do 2 year fixed rate bonds work?

No matter the term’s length, you deposit a lump sum to open any fixed rate savings accounts. After that, your money is locked in until your bond term ends.

Most 2 year fixed rate bonds have a minimum deposit amount, typically between £500 and £1,000. There’s also a maximum deposit amount, which for some savings account service providers can go into the low millions. At Raisin UK, the maximum we’ll allow you to deposit is £85,000 per banking group to ensure that your deposit is protected.

Be aware that you can’t make any further payments into your fixed rate bond account once it’s open, and it typically isn’t possible to close a fixed rate bond savings account early.

It is possible to apply for any number of fixed rate savings accounts, but keep in mind that deposit protection limits apply to the banking group that holds your money, rather than the individual savings account.

Are 2 year fixed rate bonds a good option?

2 year fixed rate bonds can be a great short-term investment option if you don’t want to take any risks with your money. This type of savings account usually offers more competitive interest rates than most other savings accounts, but does require you to go without access to your cash for 24 months.

Ultimately, the deciding factors when it comes to 2 year fixed term savings accounts are whether you can go without your money for that length of time, and if the rate of return is good enough for you.

Are other fixed terms available?

Yes. At Raisin UK we offer a range of different terms from our trusted partner banks, ranging from six months to five years. Click on the cards below for more information.

A good method for getting the most out of your money is to open several fixed rate bond accounts with different terms so you benefit from compound interest. This is demonstrated in the table below:

The benefits of 2 year fixed rate bonds

If you’re looking for a medium-term savings account and can deposit a lump sum that you’re prepared not to see again for 24 months, 2 year fixed rate bonds feature the following benefits:

The interest rate is fixed for two years

You know how much interest you’ll earn

You know exactly how long your term is and you can plan accordingly

Your money is protected from interest rate changes

Is it the right time to open a 2 year fixed rate bond?

The world can be an uncertain place. Fluctuating interest rates, coupled with soaring inflation, may leave you unsure of the best way to earn money from your savings. Fixed rate bonds could be the solution to your concerns, as they offer fixed interest rates and typically offer higher interest rates than easy access accounts and ISAs. With a 2 year fixed rate bond, you would give yourself 24 months of financial certainty.

Interest on 2 year fixed rate bonds explained

The amount of interest you earn with a 2 year fixed rate account is advertised as an annual equivalent rate (AER). How much you can earn depends on the following:

How long your fixed rate lasts for, i.e. two years

The amount you deposit

The annual equivalent rate (AER)

How the bank pays interest

If you’re a basic rate (20%) taxpayer, you can earn interest of up to £1,000 per year without paying tax. This amount is reduced to £500 if you pay tax at the higher rate (40%). We’ll talk more about tax on interest later on.

How is the interest paid on a 2 year fixed rate bond?

How you earn interest from a 2 year fixed rate bond depends on which bond you open and which bank is offering the account. At Raisin UK, the interest you earn from a fixed rate bond will usually be paid to you upon maturity at the end of your fixed term, regardless of how frequently you earn it. You can view how often you’ll earn interest and when it will be paid to you by reading the product summary of any savings account you want to apply for.

How do I get the best interest rate on a 2 year fixed rate bond?

To find the best interest rate on 2 year fixed rate bonds, you could refer to any online comparison table or do some research into which institution is offering the best rates at this time. As part of your research, always check for FSCS protection and any minimum deposit requirements. It’s always important to read the fine print before signing up to any financial product.

Our top 2 Year Fixed Rate Bond rates

Raisin UK works with a range of partner banks to offer the best possible rates on 2 year fixed rate bonds. Currently, we offer a 2 year fixed rate bond higher than the most popular high street banks.

How to find the best 2 year fixed rate bond for you

Finding the best 2 year fixed rate bond for you will ultimately depend on your financial situation, savings goals, ideal timeframe and how much money you have to invest. It’s a good idea to ask yourself the following four questions before opting for a two year fixed rate bond.

How much money can I afford to put into a fixed rate bond?

As you can’t ‘top up’ a bond after you’ve opened it, you’ll need to deposit a lump sum right at the beginning. The required deposit amount is usually £1,000 or more, depending on the account you choose. The more money you can lock away, the more interest you’ll earn by the end of your term.

How long can I go without access to my money?

You’ll effectively need to be in a strong enough financial position to wave goodbye to your deposit until the end of your term, which in this case would be 24 months. Should you need access during that time, you’ll probably have to pay a fee and may lose your competitive rate of interest.

Does the interest rate work for me?

By opting for a 2 year fixed rate bond, you’ll be able to calculate exactly how much the bond is going to make. By doing so, you can work out whether this will hit your savings target or not.

Does the interest payment method work for me?

A bank will pay your interest either monthly or at the end of your term, meaning you could receive payments each month or not until the entire 24 months are up. You’ll need to consider which you prefer.

Five things to consider in a 2 year fixed savings account

The two year term is one of the most important considerations you’ll have for a fixed term savings account, but don’t forget you’ll also need to think about:

The amount you can deposit

Deposit deadlines

The frequency with which interest is earned

How much of your money is protected

Tax implications

Do I pay tax on 2 year fixed rate bonds?

The interest you earn on 2 year fixed rate bonds is taxable, but only when it exceeds your personal savings allowance (PSA). For basic rate (20%) taxpayers, this amount is £1000, while higher rate (40%) taxpayers have an allowance of £500. If you’re a basic rate taxpayer, that means you can earn up to £1,000 in interest on your savings without paying tax.

However, additional rate (45%) taxpayers don’t receive a PSA, meaning that all of the interest you earn will be subject to tax.

Does the FSCS cover 2 year fixed rate bonds?

The Financial Services Compensation Scheme (FSCS) offers deposit protection on all savings accounts offered by regulated banks in the UK, including 2 year fixed rate bonds. The FSCS will cover deposits of up to £85,000 per person, per bank, including any interest, if your bank fails.

All of the fixed rate savings accounts from UK banks that you can apply for through our marketplace offer FSCS protection. The European Deposit Guarantee Scheme (DGS) covers savings accounts offered by European banks through our marketplace.

What happens at the end of the two year term?

At the end of your two years of fixed rate savings, you can choose from the following options:

Accept a renewal offer to open a new fixed rate bond from the same bank with your original deposit amount and choose to withdraw or deposit the interest you’ve earned

Move your matured funds to another savings account

Withdraw your original deposit with any interest you’ve earned and close the account

Discuss your options with your provider when your bond is coming to an end.

How long does it take to receive my money at the end of my 2 year fixed rate term?

When you reach the end of your term, this means your bond has ‘matured.’ With a two year or 24 month bond, you’ll usually be contacted by your bank as you get closer to the maturity date. You’ll be asked what you wish to do with the money, and you’ll get a form to complete to tell your bank what you want to do. If you want to withdraw your original deposit, you’ll typically get the money within a couple of weeks.

Advantages of opening a 2 year fixed rate savings accounts with Raisin UK

Our marketplace provides a choice of 2 year fixed rate savings accounts from UK banks, all of which are free to open. Read our handy guide to opening a fixed rate bond for more information.

If you’re looking for a savings account with a little more flexibility, consider exploring easy access or notice accounts from our partner banks.

At Raisin UK, you can apply for and manage savings accounts from a range of partner banks in one place. Simply click to apply and forget about the hassle of filling in a new application form for every savings account you open. Register for a free Raisin UK Account and to easily grow your savings.

2 Year Fixed Rate Bonds FAQs

You typically only pay money into your fixed rate bond when you open the account, as you can’t normally top them up. Your initial deposit is usually made by bank transfer, which you can do online or from your branch.

Not normally. 2 year fixed rate bonds (and all other types of fixed term bonds) usually require you to make your full deposit when you open your account. If you’re looking for a savings account that you can regularly top up, you might want to consider notice accounts or easy access savings.

You can have as many 2 year fixed rate bonds as you like. You will need to keep in mind your personal savings allowance to ensure that you pay the right amount of tax and declare any excess.

Sometimes, but there will probably be a cost. Any fixed rate bond account that lets you withdraw money early will usually charge you a fee for doing so, which could wipe out your interest.

Yes. Fixed rate bonds carry very little risk when compared with alternative investment options, and you have a guaranteed return on your investment.

No. With most fixed rate bonds, up to £85,000 of your money is protected with the FSCS. You can check that your financial institution offers this protection by searching for them on the FCA Register.

If you’re looking for something similar to a 2 year fixed rate savings account, you’ll likely suit the low-risk, interest earning benefits offered by notice accounts and easy access accounts.

Save smarter with the Raisin UK newsletter!

What’s in it for me?

- Receive exclusive updates on market-leading rates

- Ensure you never miss a bonus offer

- Keep your finger on the pulse with the latest financial news