How to transfer money to your Transaction Account to fund savings accounts

Your Transaction Account provides a quick way to open savings accounts from a range of banks, without having to fill out an application form or give your bank or building society details each time you apply. In this guide, we explain how to transfer money to your Transaction Account, including how to fund any savings accounts that you’ve opened.

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

Step 1:

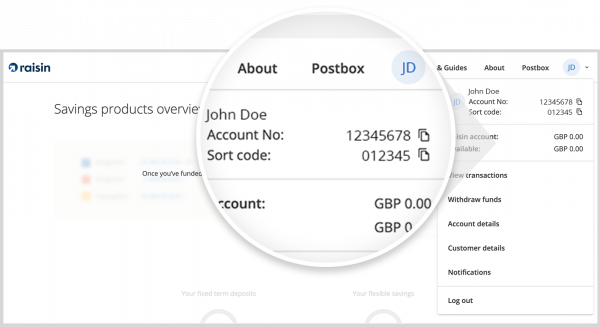

Find your Transaction Account sort code and account number – these are the details you need to use when transferring money from your nominated bank or building society account.

You can find these on the top right of the dashboard of your Raisin UK Account when you log in via our website or app. Hover over your initials to view the drop down menu with your details. Use this sort code and account number when you want to transfer money to your Transaction Account in order to open a savings account on our marketplace. When transferring funds from your nominated bank or building society account, in the payee information you should enter your name as it appears in your Raisin UK Account e.g. Joe Bloggs.

Step 2:

The bank or building society account you transfer money to your Transaction Account from must be held in your name.

You can view your nominated account by logging into your Raisin UK Account, hovering over your initials in the far right of the screen, and clicking on ‘Withdraw funds’.

You can only fund your Transaction Account from your Nominated Account. Any pay-ins from another account will be automatically returned according to your bank’s normal processing times. This is a security feature to make sure the payments come from your verified Nominated Account only.

.png)

Step 3:

Transfer money using Faster Payments

Use Faster Payments to transfer money to your Transaction Account.

Your bank will decide which default payment method to use, but may reference the method when you are setting up the payment. Some banks have set daily limits on Faster Payments, which means that if you want to fund a savings account with more than the daily limit set by your bank, you may need to do this over a number of days.

If you’re unsure how to transfer your money by Faster Payments, please contact your bank.

Step 4:

Begin funding your Transaction Account

Carefully check that you have entered your Transaction Account sort code and account number correctly before transferring any money.

You can then make as many payments as you need into your Transaction Account until you reach the full amount you require for the savings account you wish to open. However, please note that your bank may have a daily transfer limit or a limit per transaction. You may be able to temporarily adjust this limit by speaking to your bank, but you should take any transaction limits into account to ensure that you complete all transfers before the funding window (detailed in the account details) elapses.

Step 5:

Make multiple transfers

You don’t have to transfer your full deposit amount in one go. You can make multiple transfers to your Transaction Account until you reach the full deposit amount.

You can fund any new savings accounts through multiple Faster Payments money transfers to your Transaction Account, until the opening amount you chose when opening it is reached.

Note: If you decide to change the amount you want to deposit, and have yet to transfer your deposit to your Transaction Account, you can withdraw your application and re-apply, if the savings account is still available. You can do this through your Raisin UK Account by clicking ‘My savings’ in the navigation menu, then click ‘Details’ on the application you want to withdraw, and then click ‘Withdraw application’. Confirm that this is the application that you want to withdraw by clicking ‘Withdraw application’ and you will see a message confirming that your application has been cancelled. Then re-apply if the savings account is still available.

Step 6:

Wait for your funds to arrive

It shouldn’t take long for your transferred money to become available in your Transaction Account, typically straight away. Once your money is available, you can view your available balance from the dashboard of your Raisin UK Account after logging in.

.png)

Step 7:

Your savings account application will be reviewed

Once you have applied for a savings account and transferred your full deposit amount, your deposit amount will be set aside from your available balance, and your application will be reviewed. Once your application has been approved, your full deposit amount will transfer to the partner bank automatically.

It typically takes less than two business days from when your full deposit amount is available in your Transaction Account for an approved savings account to open.

If you want to know more about your Raisin UK Account or Transaction Account, consider reading our other guides or exploring our FAQs page.

* If your nominated account details don’t look correct, or you need to change your nominated bank or building society account, you can do so by sending us a scanned copy, photo or a PDF of a statement for the bank or building society you want to make your nominated account (providing it’s less than three months old) by secure message through your Raisin UK Account.