1 year fixed rate bonds: rates up to 4.33% AER

✓ Lock away your money for one year to earn a competitive fixed interest rate

✓ Peace of mind that the rate won't decrease during your term

✓ Perfect for long-term saving goals on our no-fees marketplace

View and compare top 1 year fixed rate bonds

Your money journey

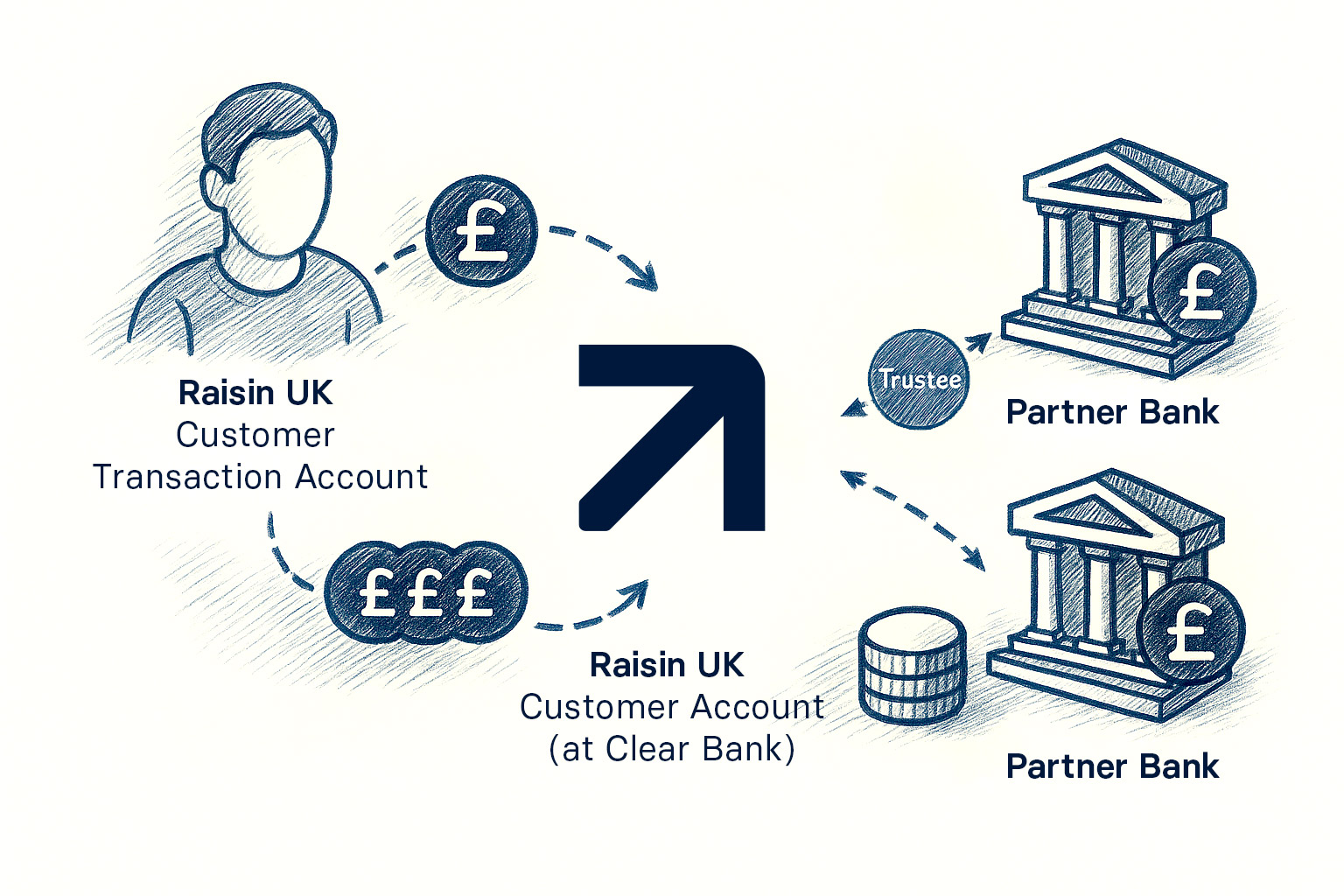

This diagram shows the journey of your money from your bank or building society account to a savings account:

Your money’s journey begins when you transfer funds from your Nominated Account to your Raisin UK Transaction Account, held at Clearbank.

When you place a deposit with one of our partner banks or building societies, the funds are transferred to a bare trustee (Raisin Platforms Limited) or may be transferred directly to your chosen partner bank.

When you choose a product with a partner bank that uses a bare trustee, Raisin Platforms Limited will place the money you wish to invest into your chosen partner bank's savings account and will return your money, along with any interest or profit, to you on maturity. Raisin Platforms Limited has no claim to your funds and administers them on your behalf while providing this service.

To learn more about this process, and the role of trustees, please read our FAQs.

Why should you save with Raisin UK?

Easy money management

Our simple online platform and app allow you to manage your money easily at any time. With all your accounts under one roof, there’s no need to juggle multiple logins, either.

Access to more banks

Why limit yourself to the high street? With more banks at your fingertips from across the UK and Europe, we give you more choice to find the right savings account for you.

Extra savings boosts

From our refer a friend bonus to exclusive savings accounts offers, it’s easy to make your money work harder. We’ll always make sure you’re the first to hear about new top rates, too.