Comparing fixed rate bonds: NS&I vs. Raisin UK

National Savings & Investments (NS&I) offered its highest-ever rate on fixed rate bonds in 2023, but rates have since come down. So, what are the new NS&I interest rates? And where should you look to get the best rate on your maturing bond?

We compare the current rate on NS&I fixed rate bonds to other savings accounts to see if you can get more from your savings. Discover which alternative accounts might be suitable for you.

NS&I bond rates: Interest rates for NS&I bonds peaked in 2023 but have since decreased. Current rates may not be as competitive as other options.

Alternative savings options: Fixed rate bonds from other providers, such as Raisin UK, might offer better interest rates than NS&I’s current fixed-rate offerings.

Reinvesting your bond: When reinvesting maturing bonds, you might consider additional factors like when you will need access to your savings.

What are the new NS&I interest rates for 2025?

We’ve put together a table of the current NS&I interest rates for some of its savings products (correct as of March 2025). Keep in mind that these rates are frequently reviewed, and can change at any time.

Type | Product | Interest rate |

|---|---|---|

Variable | Premium Bonds | 4.00% annual prize fund rate, variable (until the March 2025 prize draw); 3.80% annual prize fund rate, variable (from the April 2025 prize draw) |

Easy access | Direct Saver | 3.30% gross/AER, variable |

Income Bonds | 3.26% gross/3.30% AER, variable | |

ISAs | Direct ISA | 3.50% tax-free/AER, variable |

Junior ISA | 4.00% tax-free/AER, variable | |

Investment account | Investment Account | 1.00% gross/AER, variable |

Fixed term | Guaranteed Growth Bonds (British Savings Bonds) | 3.50% gross/AER, fixed for 3 years |

Guaranteed Income Bonds (British Savings Bonds) | 3.44% gross/3.49% AER, fixed for 3 years | |

Green Savings Bonds | 2.95% gross/AER, fixed for 3 years |

These are the interest rates for general sale, i.e. they are open to new customers. If you are looking to renew a maturing bond, you will likely have more options and different rates.

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

What are the NS&I historical interest rates?

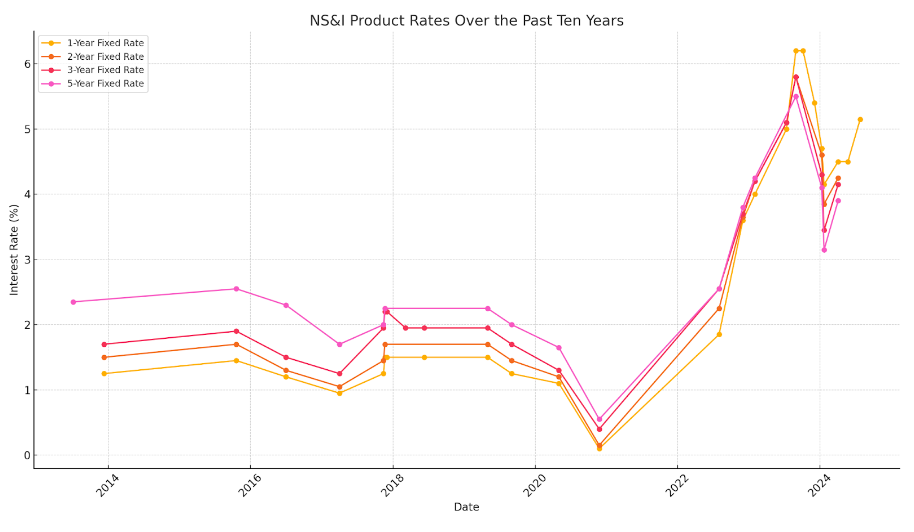

In August 2023, NS&I’s 1-year Guaranteed Growth and Guaranteed Income Bonds paid a record rate of 6.2% AER. Many savers took advantage of these top rates before they were withdrawn in October 2023.

Since then, some rates have decreased. This decline is evident across all NS&I fixed rate bonds; rates have fallen by at least 1.0 percentage point compared to a year ago.

The chart below illustrates the changes in NS&I Guaranteed Growth Bond rates for both new issues and renewals over the past decade:

Source: https://www.nsandi.com/historical-interest-rates

From this graph, you can see that NS&I bond rates have risen steadily over the past three years, hitting their peak last year, before falling sharply. The same pattern can be seen with NS&I interest rates on income bonds. While both products have regained some lost ground since, they still tend to fall short of the more competitive rates found on fixed-rate savings options elsewhere.

Comparing fixed rate bonds: NS&I vs. Raisin UK

If you want to continue locking your cash away to take advantage of potentially more competitive rates, it can be helpful to compare the current NS&I bond rates with those offered by other providers.

NS&I’s fixed rate bonds, such as Guaranteed Growth Bonds and Guaranteed Income Bonds (also known as British Savings Bonds since the 2024 budget), offer a range of term lengths if you are renewing an existing bond. However, it can sometimes pay to shop around, as you may be able to secure a more attractive interest rate for your desired term.

Taking the Guaranteed Growth Bonds as an example, in the following table, you can see how the rates compare to fixed rate bonds on the Raisin UK marketplace.

Fixed term | NS&I bond rates: Guaranteed Growth Bonds | Raisin UK top rates: fixed rate bonds |

|---|---|---|

Two years | 3.60% gross/AER | 4.32% AER |

Three years | 3.50% gross/AER | 4.36% AER |

Five years | Closed to new customers as of January 2025 | 4.30% AER |

Please note, these rates are correct as of March 2025. As with NS&I’s Guaranteed Growth Bonds, you’ll need to commit your savings for the full term with Raisin UK’s fixed rate bonds.

By considering these alternatives, you can potentially secure a better return on your investment.

Why are NS&I rates changing?

In the 2023 financial year, the government set NS&I a target to attract £7.5 billion from savers. To reach this goal, and prevent savers moving to banks offering better rates, NS&I boosted its interest rates and Premium Bond prize rates.

This approach seems to have worked well. For instance, the 1-year Guaranteed Growth Bond, offering a 6.2% rate - the highest ever for NS&I - was so popular that it closed just five weeks after launch.

Now that NS&I has surpassed its target, it can afford to reduce interest rates again, and this has resulted in the recent rate cuts.

Considerations when reinvesting your maturing bonds

When your bond is about to mature, you might start by comparing rates for different savings products. NS&I typically sends a letter about a month before maturity, showing how much you would earn by renewing your current bond. You could use this as a starting point to compare with rates from other providers.

Premium Bonds are not directly determined by the Bank of England or any other market interest rate, whereas any reductions or increases to the Bank’s base rate are likely to be passed on to savers without fixed rates. For more information on how this affects savers, it can be helpful to see what is happening with interest rates.

Options for reinvesting your maturing bonds

When reinvesting your maturing bonds, you might consider the features that matter most to you.

Fixed rate bonds offer the benefit of a guaranteed interest rate for a set term, so you know exactly how much you’ll earn. If you want competitive rates with a bit more flexibility when it comes to accessing your cash, a notice account might be worth considering. These accounts typically require you to give 30 to 90 days’ notice before withdrawing your money, but they still offer attractive variable interest rates.

If you want the freedom to withdraw and add to your savings at any time, an easy access savings account might suit you. Currently, Raisin UK offers rates of up to 4.25% AER variable, compared to the current NS&I Direct Saver interest rate of 3.30% AER variable.

Read our page on where to invest your savings after your bond matures for more information.

How does tax compare on NS&I bonds vs. savings accounts?

The interest you earn on most savings is considered taxable income. This includes NS&I fixed rate bonds, as well as standard savings accounts. However, whether you actually pay tax on it depends on the total amount of interest you earn and your tax rate. Under the Personal Savings Allowance (PSA), basic rate taxpayers can earn up to £1,000 in interest per year tax-free, while higher rate taxpayers have a £500 limit.

An exception is Premium Bonds from NS&I. Instead of earning interest, they offer the chance to win tax-free cash prizes, although two-thirds of Premium Bonds holders have never won. If you already hold an index-linked Savings Certificate, you won’t pay tax on any returns you earn.

To avoid tax entirely and potentially maximise your earnings, you might consider a cash ISA. You can deposit up to £20,000 per year (as of the 2025/26 tax year) into a cash ISA and earn interest tax-free. And fixed rate ISAs might offer slightly higher returns if you’re willing to lock your money away. Read more in our guide to Premium Bonds vs. ISAs.

What are the benefits of NS&I fixed rate bonds?

There are a few reasons why you might still be keen to invest in bonds with NS&I.

- Government backing: As a government-backed bank, NS&I offers 100% security for your savings through HM Treasury.

- High deposit limits: NS&I allows you to deposit up to £1 million, which could be ideal if you have a large sum, such as from an inheritance. In contrast, most other financial institutions are limited by the Financial Services Compensation Scheme (FSCS), which protects only up to £85,000 per person, per bank.

- Access to earnings: If you prefer to access your earnings regularly, NS&I’s Guaranteed Income Bonds offer this option, making them a good fit if you need periodic payouts.

However, as we’ve seen, these benefits may come with the trade-off of a less competitive interest rate.

Find competitive savings rates at Raisin UK

One way to get more from your savings is to shop around for the best rates. At Raisin UK, we offer a wide range of easy access savings accounts, notice accounts, and fixed rate bonds. You can easily find an account to suit your needs from a variety of banks and building societies. Simply register for a free Raisin UK Account, choose a savings account, deposit your money, and watch your savings grow!