4.42%

AER

Fixed rate bond

United Kingdom

(AA)

Rate reducing soon

Sharia account

The UK is a nation of keen gardeners and keen savers. Curious to uncover the similarities between the nation’s saving and gardening habits, we commissioned a survey of 2,000 people to find out how long people spend gardening vs. researching their savings, which regions spend the most time gardening and saving, and how people think the two topics are related. Here’s what we found…

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

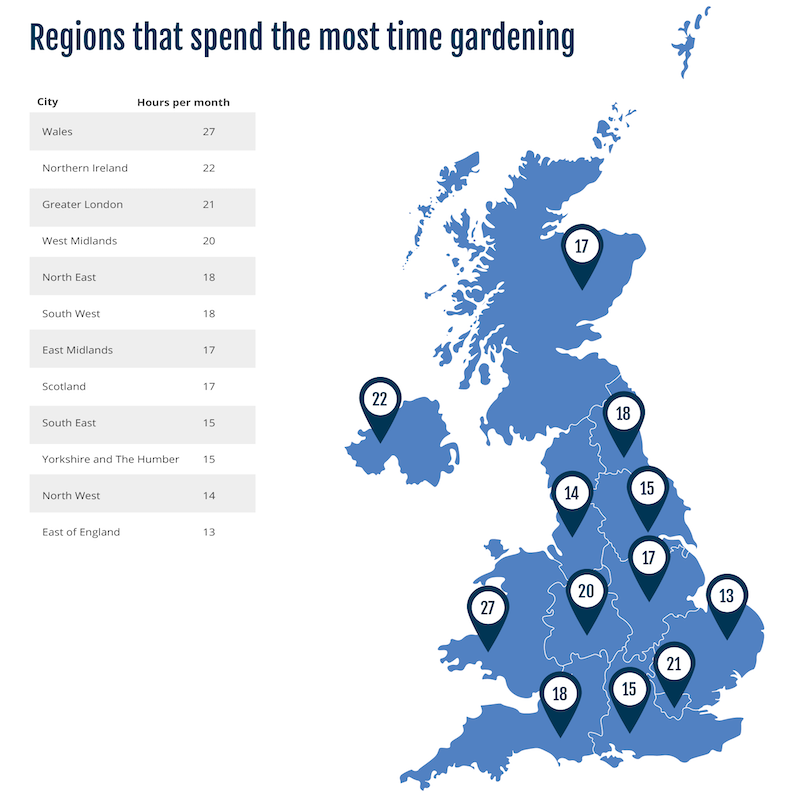

Wales is renowned for its picturesque natural beauty, so it’s not a huge surprise to learn that Welsh gardeners spend an impressive 27 hours per month tending to their outdoor spaces (a whole 10 hours higher than the UK average).

At the other end of the scale, residents in the East of England and the North West spent just 13 and 14 hours respectively in the garden. Surprisingly, residents in the South East - home to ‘the Garden of England’, Kent - spent just 15 hours gardening per month.

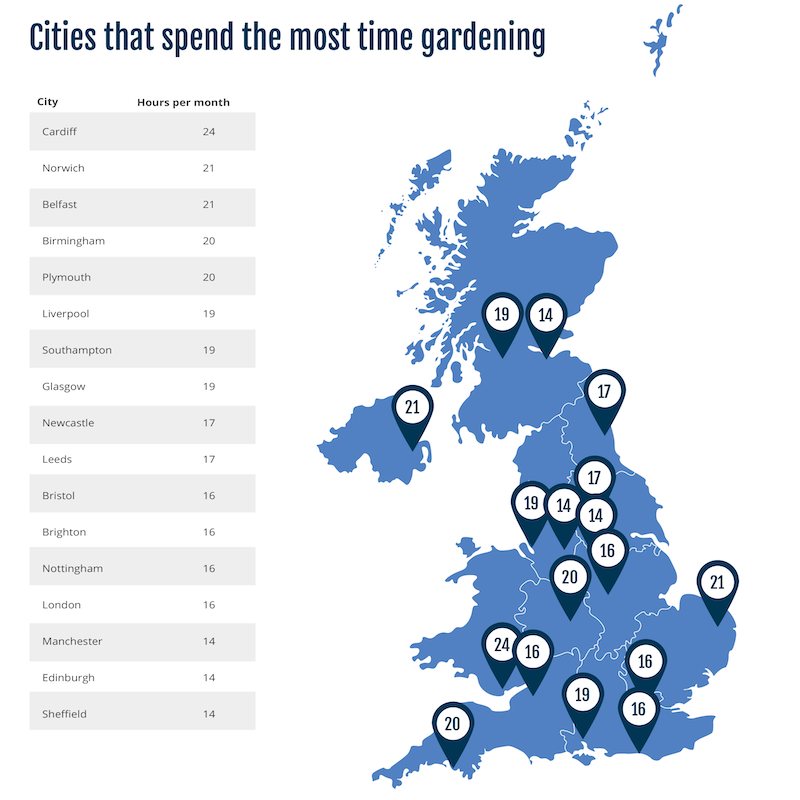

Cardiff is the UK's gardening capital, with locals investing 24 hours each month into their gardens – that’s 41% longer than the UK average of 17 hours.

Sheffield, which is often described as having more trees than people, was one of the areas where people spend the least time gardening (14 hours), alongside Manchester (14 hours) and Edinburgh (14 hours).

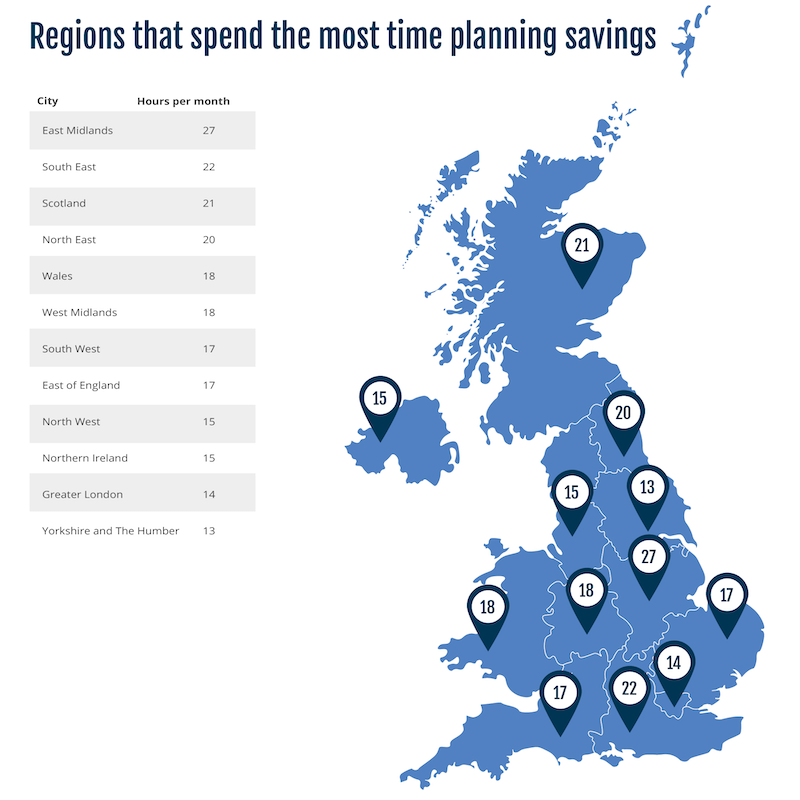

On average, people in the UK spend 16 hours a month researching savings accounts - only an hour less than they spend gardening on average.

Regionally, however, there are quite a few differences in priorities. Residents of Wales, the UK’s most dedicated gardening region, spend just 17 hours planning their finances - 10 hours less than they spend pruning their hedges and planting their flowers.

Residents of Nottingham and Sheffield spend the most time planning their savings, with Cardiff - where people spend the most time gardening - sitting in mid-table. Leeds is at the bottom of the list, with just 9 hours on average spent planning savings each month.

Kevin Mountford, co-founder and personal finance expert at Raisin, said:

“While at first savings and gardening might not appear very similar, there are many elements to gardening that translate to saving. It’s not just about personality traits like being calm, organised and adaptable - it is about the long game. In both cases, taking time up front to research your options based on your specific situation can see you make great rewards down the line. For example, with savings specifically, if you have the cash available, putting it into an ISA or fixed rate bond could see you benefit from competitive returns on your investment over time.”

Like growing a beautiful garden, building your savings requires the right tools and the right mindset. Raisin UK gives you everything you need to make your savings bloom, with competitive rates from over 40 FSCS-protected banks or building societies.

Manage your money across easy access savings, fixed rate bonds and notice accounts with a single log-in.

Open your free Raisin UK account and apply once for access to our entire range of accounts.

Why stick to the high street? Grow your money with accounts from over 40 banks and building societies.

All banks and building societies on our platform offer FSCS (or European equivalent) protection.