State pension eligibility explained

State pension in the UK is a regular payment you can claim from the government once you reach state pension age. Although every UK citizen has the opportunity to qualify for this payment, your entitlement to the state pension will depend on how much National Insurance you’ve paid during your working life.

On this page, you’ll learn more about the state pension, what being eligible means, what requirements you’ll need to meet and the different types of state pension. We also consider some of the other ways you can boost your retirement income, such as high-interest savings accounts.

Weekly income: Your state pension is the weekly income you could receive from the government once you reach your state pension age

Entitlement: State pension entitlement depends on several factors, including when you reached the state pension age and how many National Insurance qualifying years you’ve worked for in the UK

Claims: All you need to claim your state pension is your National Insurance number and proof of your date of birth

What is the state pension?

The state pension is a weekly payment from the government that you may be entitled to receive when you reach your state pension age. The amount you’ll receive will depend on how many National Insurance qualifying years you have worked. You usually make National Insurance contributions when you’re working, and you’ll have contributions credited to you when you’re not working.

What does state pension entitlement mean?

You’re only entitled to claim the state pension if you meet all of the eligibility criteria. You’ll be eligible to claim a state pension if you’ve worked for at least 10 years in the UK and have paid National Insurance contributions during that time. The amount you’ll receive will depend on the number of National Insurance qualifying years you’ve worked. You can check how much state pension you may be entitled to on the Gov UK website.

You’re entitled to claim your state pension today if you were born before the 6th April 1951 if you’re a man, and before the 6th April 1953 if you’re a woman. The earliest you’ll be eligible to claim a state pension is when you’ve reached your state pension age. You cannot make a claim before this time. The current state pension age is 66 for both men and women, although this is set to rise in the coming years. You can check your state pension age here.

What are the requirements for getting a state pension?

Even if you satisfy all of the state pension entitlement criteria, you won’t automatically start receiving your state pension when you reach pension age. In most cases, you’ll get a letter from the Pension Service between two and four months before you reach your state pension age.

This letter will include instructions on what you should do to claim your pension. It will usually set out the three ways for claiming, which are to:

- Claim your state pension online

- Claim over the phone by calling the pension claim line on 0800 731 7898

- Complete and return a pension claim form by post

You’ll need to provide your National Insurance number, and you may need to provide evidence of your date of birth.

If you haven’t or can’t receive a letter, you can make your claim by calling the Pension Service on 0800 731 7898.

What is the state pension triple lock system?

The UK government set up the ‘triple lock system’ in the financial year 2011/12, and it has been applied every year since, apart from a temporary suspension in 22/23. The triple lock is a guarantee that the state pension will rise each year, in line with the highest of the following factors:

- Average earnings (or wage growth) as measured between May and July the year before the rise comes in. For 2023, this was 8.5%

- The consumer price index measure of inflation as measured using September’s inflation figure from the previous year. For September 2023, this was 6.7%

- Or 2.5%

What are the different types of state pension?

There are three different types of state pension; basic state pension, new state pension and an additional state pension.

- Basic State Pension: You’ll get a basic state pension if you reached your state pension age before the 6th April 2016. The full basic state pension is £156.20 a week for 2022/23. You will receive this amount if you have a total of 30 qualifying years of National Insurance contributions or credits. If you have fewer than 30 qualifying years, your basic pension will be less than the full amount, depending on how many years you’ve worked. However, you can top your pension up by making voluntary National Insurance contributions.

- New State Pension: You’ll be able to claim a new state pension if you reached your state pension age after the 6th April 2016. You’ll need at least 10 qualifying years of service to receive any state pension. The full amount you can receive under the new State Pension is £203.85 a week, and to claim this amount you’ll need to have served 35 qualifying years.

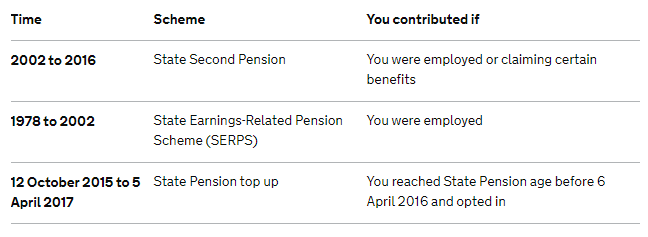

- Additional State Pension: If you reached state pension age before the 6th April 2016 and have started claiming your basic state pension, you may be entitled to an additional state pension. You may be eligible if you’ve contributed to one of these three schemes:

Am I entitled to the state pension?

Every UK citizen has the opportunity to qualify for a state pension, and you’ll be eligible to claim if you’ve made enough National Insurance contributions. Once you reach your state pension age and you’ve worked at least 10 qualifying years, you’ll be able to claim your state pension.

Are there other ways to earn an income once I’ve retired?

If you want the security of another income stream alongside your state pension, there are other ways of saving for retirement. You might want to consider one or more of the following options:

- Investing, which offers potentially high returns but comes with high risks

- Individual savings accounts (ISAs), which help you save up to £20,000 per year tax-free

- Opening a competitive interest rate savings account, which is probably the safest way to save. If you’re happy to lock your money away for a set period (typically between six months and five years), a fixed rate bond may be an ideal option. These types of accounts tend to offer the highest rates of interest and can be a good way to maximise the return on your savings.

If you want to quickly and easily open a savings account, register for a free Raisin UK Account and apply today. It’s free to open savings accounts with competitive interest rates from a range of partner banks through our marketplace, so why not give it a go? And with deposits protected under the Financial Services Compensation Scheme (or European equivalent scheme), you can rest assured that your savings are in safe hands.