Rising fixed deposit interest rates: better to invest now than wait

Since spring, fixed rate deposits have been increasing daily. Following the Bank of England’s record interest rate hike in August, most people expect this interest rate rise to continue. Many savers are therefore likely to wait for further interest rate jumps, before investing their money on a fixed basis for a longer period. But is that costing you more in the long run? Raisin UK, the marketplace for investing money, shows how savers can profit effectively and stop the fear of missing out (FOMO) from eating into their interest.

Why interest rates are rising

The Bank of England has raised its base rate by 0.5 %, the largest single upward jump in 27 years. It takes the base rate to 1.75%, its highest level since 2008. This latest interest rate hike will affect personal finances and reflects the Bank’s efforts to control rampant inflation amid the cost of living crisis in the UK. The government tasked the Bank of England with maintaining UK inflation at a stable level of 2% a year. At present, inflation is way above this target at 10.1%, and it’s currently forecast to reach 13% by October. Among the main reasons for this high inflation is the massive surge in the prices of global energy, grain and other key commodities. This has been caused by recent supply chain disruption and the Russian war on Ukraine.

In theory, the rise in the Bank of England base rate should be good news for savers with bank and building society accounts. However, as rates are rapidly rising and the temptation to ‘wait out’ for a better rate increases, consumers are effectively eroding their current savings through the effect of inflation.

Waiting costs

A simple example shows how much money can be lost through indecision: Anyone who wants to save £10,000 by summer 2023 could currently invest the money at an interest rate of 3.50% AER for 12 months and would end up with £350 in interest. However, if you wait another six months for the banks’ next interest rate steps and then invest the savings for six months, you would only receive a return of £185 even at a higher interest rate of 3.7% AER. – a whole £185 less. For interest earnings of £350 – as with the one-year investment – the interest rate would even have to double again, to 7% AER.

So for indecision to pay off, very large interest rate increases are needed. If it is clear that the savings will not be needed in the next 12 months, it is almost always more lucrative to invest them directly. Anyone who is uncertain about this, also against the backdrop of rising energy costs, is playing the right card with a flexibly available easy-access account. Even though easy-access interest rates are considerably lower, they have risen significantly in recent months and are now sometimes as high as 1.9% AER. .

Save efficiently with the deposit ladder strategy

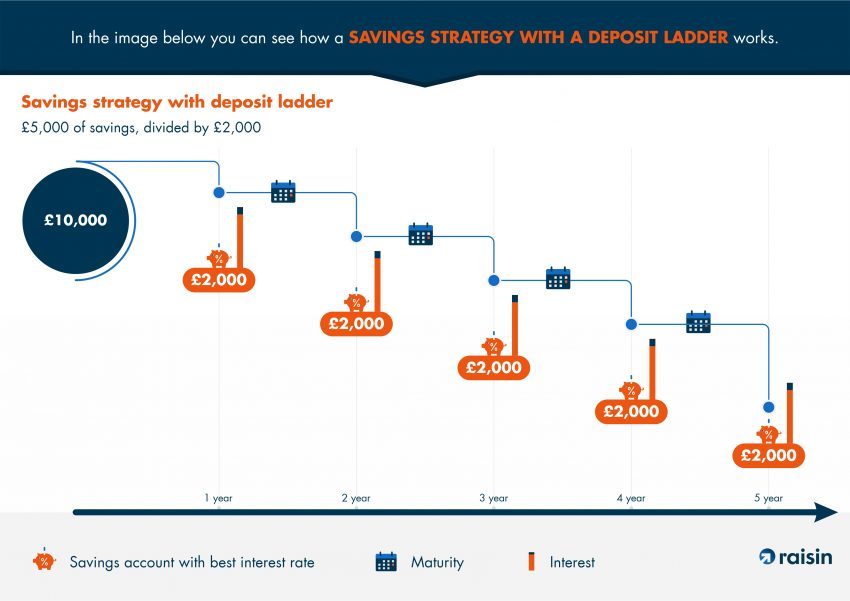

The ladder strategy offers an alternative: consumers who want to invest their money at fixed interest rates can benefit optimally from rising interest rates by saving money over the long term with different maturities, thus bridging the waiting period for higher interest rates. The ladder strategy works quite simply: For example, an investment sum of £10,000 is divided up and £2,000 each are invested at fixed interest rates with terms of 1, 2, 3, 4 and 5 years. After just one year, the first investment amount, including accrued interest, is paid out and can then be invested again at the highest interest rate. In the following year, the two-year term deposit is due, and so on. With the deposit ladder strategy, savers take advantage of rising interest rates without having their money parked in checking accounts for months on end, earning no income.

Kevin Mountford, co-founder of Raisin UK, commented: “It doesn’t pay to wait when it comes to saving. Even if interest rates continue to rise, consumers should take action now. Every day there is still £millions sitting in low to no-interest bearing accounts, like current accounts, where inflation hits full force and the money loses value. With the deposit ladder strategy, interest can be earned quickly and still take advantage of future interest rate increases. Those who need the money in the short term can make it work for them in an easy access account, and for those looking for a longer term strategy 1-year fixed rate bonds are an excellent option. At Raisin UK we currently have an exclusive 1-year bond earning 3.50% AER.”

Austria

Austria

Finland

Finland

France

France

Germany

Germany

Ireland

Ireland

Netherlands

Netherlands

Poland

Poland

Spain

Spain

United Kingdom

United Kingdom

United States

United States

Other (EU)

Other (EU)