Over 50s savings accounts

When you hit your 50s, life can take a different twist. Priorities shift, finances change, and you may find more options open up for you in terms of savings accounts. But not all savings accounts are right for everyone, and you’ll find many financial institutions have specialised over 50s savings accounts.

In this article, we take a quick look at all you need to know about savings accounts for the over 50s, and unravel whether it’s really worthwhile setting up a savings account based on your age. We also compare options such as high-interest fixed rate bonds, notice accounts, and the best instant access savings accounts for over 50s.

Tailored options: In your 50s, you might look into specialised over 50s savings accounts for competitive rates, but keep in mind that standard accounts may offer comparable or better options

Saving accounts: Over 50s can choose from various accounts - easy access, notice, fixed rate bonds, ISAs, and regular savings - each suited to different preferences and goals

What to consider: You might prioritise interest rates, account management, or deposit protection features when choosing a savings account for over 50s

What are the benefits of over 50s savings accounts?

‘Silver-era’ savings accounts sound like an exclusive and attractive option – and they can be. What you really want from a savings account is one with a minimum deposit, a generous interest rate, and a sign-up bonus. Here are some of the benefits you can experience with an over 50s savings account:

Competitive interest rates – The whole point of a savings account is to stash money away and let it grow. An over 50s savings account should have a competitive interest rate to facilitate that.

Securing your financial future – With retirement on your mind or later life adventures bubbling beneath the surface, it’s important that your over 50s savings account makes you feel safe and secure about your financial future. Access choices that work for you – There are a couple of different options when it comes to over 50s savings accounts. If you want easy access to your money and minimal restrictions, you might opt for an easy access savings account, also known as instant access savings accounts. If you want to get serious about your savings, you could look at fixed rate bonds or notice accounts. Notice accounts (more on those below) may offer more competitive rates, but ‘notice’ will need to be given to your provider before you can make a withdrawal.

Different types of accounts for the over 50s

There are different types of accounts geared towards those in the latter half of their life who are looking to save. You will often see these accounts touted as over 50s savings accounts and, while they can be useful, they don’t always offer anything different to other types of savings accounts. What savers typically want (at any point in life), is an account that offers the most competitive interest rates and that is well-matched to their needs. So, the best rates for those over 50 will generally be the same as those available on a standard savings account. Here are some of the best savings accounts for over 50s, and indeed those of all ages:

Easy access savings accounts

Easy access savings accounts

Instant or easy access savings accounts are exactly what they sound like – a savings account that allows easy access to your money. The best instant access savings accounts for over 50s tend to have minimum restrictions, meaning that you can top up and withdraw as much as you like without having to give notice. These accounts are great if you want flexibility and easy management when it comes to your savings.

Notice accounts

Notice accounts are a little more structured and restrictive when it comes to withdrawing your money. If you’re serious about saving and want to build up a nest egg, that can be a good thing. A notice savings account will often offer more competitive interest rates than more flexible types of savings accounts. The notice period can vary, but is usually between 30–180 days. These accounts are great for those who want more structure around their savings.

Fixed rate bonds

Fixed rate bonds are another important type of savings account for over 50s to consider. With this type of savings account, you lock your money away for a fixed period of time – and you also lock in the interest rate. This can be great for those times when you have a stash of cash that you don’t need access to for a fixed amount of time. Likewise, you can also avoid interest rate uncertainty. Fixed rate bond terms can run for six months to five years. Typically, the longer you lock your money in for, the better interest rates you stand to earn.

Individual savings accounts (ISAs)

If you’re over 50, you might consider Individual Savings Accounts (ISAs). With tax benefits and flexible options like Cash ISAs and Stocks and Shares ISAs, you have the opportunity to save and invest in a way that suits your financial situation. Whether you’re thinking about retirement, saving for your children or grandchildren, or simply looking to optimise your savings, exploring ISAs can be a valuable step tailored to your unique financial goals and preferences.

Regular savings accounts

Regular savings accounts can be a suitable option if you’re over 50. These accounts offer a simple and disciplined way to pay in a fixed amount each month. While interest rates may not be as high as some investments, the best regular savings accounts for over 50s provide a stable option for steadily growing your savings, making them a practical choice for those seeking a reliable savings strategy. Consider your specific financial goals when deciding on the best savings option for you.

Are over 50s savings accounts worth it?

Over 50s savings accounts can be worth it, depending on the rates of interest and the terms that are being offered. Sometimes, banks will upsell over 50s accounts, but they may not have any additional value over a standard savings account. That’s why it’s important to compare the market and read the small print. If you find an over 50s savings account with favourable rates and flexible terms, it could certainly be worth the investment.

Pros and cons of savings accounts for over 50s

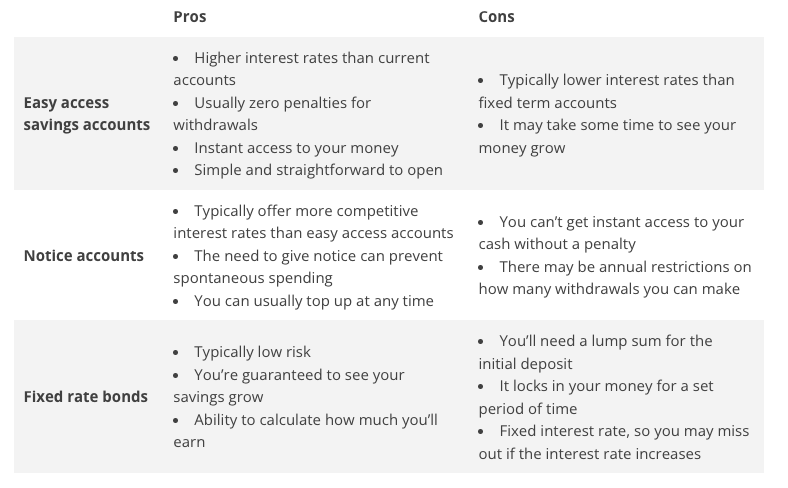

Easy access savings accounts for the over 50s could be a great option if you’re looking for a flexible way to grow your savings. Also, some of the best instant access savings accounts for over 50s have higher interest rates than current accounts. If you want an even more competitive interest rate and more of a barrier between you and your spending, a notice account could work out better. For some people over 50, the peace of mind that comes with easy access to finances is more valuable than locking in higher rates. Here are a few pros and cons of these types of savings accounts:

How to choose the best savings account for over 50s

Finding the best savings accounts for the over 50s means balancing high interest rates with other key factors, such as deposit protection and account management. While comparing the market will help you to get the best interest rates, you should always read the small print to check the finer details of how an account will work for you.

Here are some things to consider when choosing an over 50s savings account:

Interest rates – Interest rates will likely be your top priority when picking an account that works for you. Raisin UK lets you compare savings accounts so you can see how the numbers look. Whether you’re interested in easy access savings, notice accounts, or fixed rate bonds to make your money work a bit harder, Raisin UK can connect you with banks and building societies that offer competitive interest rates.

Account management – What do you want from your savings account when it comes to self-management? Do you want something you can open quickly and easily, or are you looking for an account you can access at all times? Maybe you would prefer an account with stricter policies to ensure your rainy-day fund stays out of reach and keeps growing?

Restrictions - When choosing an account, you might consider potential withdrawal restrictions, notice requirements, penalties for early withdrawals, annual contribution limits, and monthly deposit restrictions. It’s a good idea to review these details with each account provider to fit your financial goals and preferences.

Protection – When comparing accounts, it’s a good idea to look for one that comes with FSCS protection. This will ensure that your money is protected if your bank collapses. Typically, FSCS protection will cover up to the value of £85,000 per person, per banking group.

Over 50s savings accounts can be a solid choice if you find one that offers a truly competitive deal. However, you might find savings accounts that are better suited to you that aren’t necessarily targeted at the over 50s. So, make the most of your money and explore all your options.

Register for a savings account with Raisin UK

Opening a high-interest savings account with Raisin UK is quick and easy. Simply register for a Raisin UK Account and log in to browse competitive savings accounts from our range of partner banks and building societies.

Registration only takes a few minutes, and it’s completely free to apply and open an account. Once your application has been approved, simply make your initial deposit, sit back and watch your savings grow.