Interest rates explained

This guide to interest rates explains what they are, how they work, the different types of UK interest rates and how best to compare savings accounts with different interest rates.

Impact: Both investors and those borrowing money are impacted by interest rates

AER: The Annual Equivalent Rate makes it easier to compare savings products with different terms

Compounding: The effect of compound interest can make a big difference to the value of your savings over time

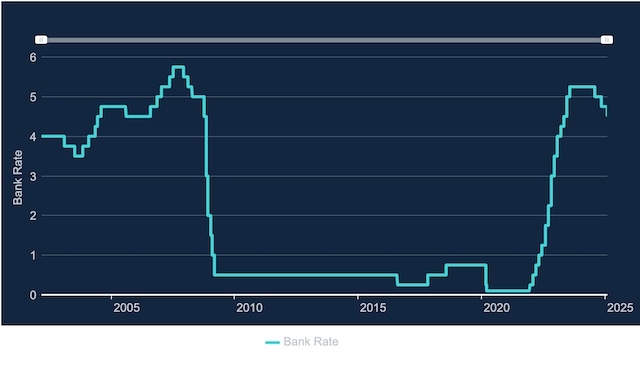

What is the current interest rate in the UK?

The current interest rate, or base rate, in the UK is 4.5% (set on 6 February 2025).

The best interest rates in the Raisin UK savings marketplace are subject to change, but generally, the best bank interest rates are available on fixed term savings accounts. The way a bank operates a savings account could make a difference, though, so be sure to read the details before applying.

What are interest rates?

Interest rates are either the percentage you earn from the money you’ve saved or the percentage you’re charged for the money you’ve borrowed.

Interest rates are usually expressed as an annual percentage, but they can be calculated over shorter periods. They vary depending on the financial provider and the type of financial product you choose, as well as various other factors (more on this below).

How do interest rates work?

Interest rates work by changing in line with changes to the Bank of England (BoE) base rate (also known as the bank rate), impacting both borrowers and savers.

If the BoE base rate goes up, the cost of borrowing will probably increase, but savers might earn more on their deposits. There are countless other factors that could influence banks to change their interest rates, including changes in demand and the interest rates offered by other banks.

What is the UK base rate?

The UK base rate set by the BoE is the rate of interest commercial banks are charged for loans by the UK’s central bank. The base rate influences the interest rates that banks then charge borrowers or offer to savers.

The BoE can use the base rate to stimulate or deter consumer spending, depending on how the economy is performing. If the economic circumstances are particularly bleak, the BoE can even use negative interest rates to encourage growth.

The current base rate is 4.5%. It can also be checked on the Bank of England website.

What are the different types of interest rates?

There are two main types of interest rates; the simple interest rate and the effective interest rate (typically referred to as AER).

What is the simple interest rate?

The simple interest rate can be broken down into the nominal interest rate and the real interest rate. The nominal interest rate is the given rate on which interest payments are calculated or the rate on which savings earn interest over time. For example, a deposit of £10,000 at a nominal interest rate of 2% over one year would earn you interest of £200.

The real interest rate takes the impact of inflation on nominal interest rates into account by deducting the rate of inflation from the nominal interest rate. For example, if the nominal interest rate is 2% and the inflation rate is also 2%, the real interest rate is 0%.

What is the effective interest rate (AER)?

The effective interest rate, also called the AER or Annual Equivalent Rate, is the interest rate used for savings accounts in the UK. It is calculated by combining interest earned on your savings over a one year period with the amount you originally deposited. This is known as compound interest, which means that any interest earned over the following year will be calculated on your original deposit as well as the interest you earned during the previous year.

AER is often used to compare annual interest rates with different compounding terms (daily, monthly, annually, etc.). For example, a nominal interest rate of 5% when compounded quarterly would equate to an effective rate of 5.095%, compounded monthly at 5.116% and compounded daily at 5.127%.

How does compound interest work?

Compound interest is effectively interest that’s paid on money that’s already earned interest. It might sound confusing, but it’s worth taking the time to understand as compound interest can make a big difference to the value of your investment.

For example, let’s say you invest £1,000 in a savings account earning 2.5%. After 12 months you’d have £1,025. The following year, you’d earn 2.5% on £1,025 (your original investment plus one year’s interest). As shown in the table below, the longer you save, the greater the effect.

Year | Balance | Annual interest | Closing balance |

|---|---|---|---|

1 | £1,000 | £25 | £1,025 |

2 | £1,025 | £25.63 | £1,050.63 |

3 | £1,050.63 | £26.26 | £1,076.89 |

4 | £1,076.89 | £26.92 | £1,103.81 |

5 | £1,103.81 | £27.59 | £1,131.40 |

What is APR?

APR stands for Annual Percentage Rate. APR is the interest rate displayed when borrowing money and includes any fees incurred when you take out a loan. Just like the AER for savings accounts, the APR is useful because it sets a comparison benchmark for loans.

Why are there different types of interest rates?

Different interest rates exist as some are better suited to specific financial products than others. As well as the Bank of England’s base rate, factors that determine the interest rates offered by financial providers include the following:

- The type of savings account

- The residual term

- The currency of the account

- The number of commercial banks in the country

- National projections of savings vs credit

- The risk to the bank

Fixed interest rates vs variable interest rates

Fixed interest rates

Fixed rates of interest allow you to know exactly how much you’ll pay back on a loan or earn from a savings account, and this amount won’t change, even if the BoE base rate changes. For example, with a fixed rate or fixed term savings account, you can lock your money away for a set period of time at an interest rate that stays the same from the day you open your account until the end of your term. Fixed rate bonds can be preferable during times of uncertainty, as you don’t have to worry about interest rates dropping.

Variable interest rates

A variable rate of interest allows your financial provider to increase or decrease your interest rate at any time. A financial provider will typically do this in response to a BoE base rate change, but other factors can result in a rate change. For variable rate savings accounts, this means that you could earn more or less from your savings deposits, depending on whether the rate increases or decreases.

How is interest paid?

How interest is paid depends on your savings provider, but it’s usually paid annually. It’s always best to check the details of the savings account you’re applying for, as interest can also be paid quarterly, monthly or even daily. You’ll typically earn more from a savings account if interest is calculated more frequently.

How to compare interest rates

If a financial service provider doesn’t use a standardised method of comparing interest rates, it can be difficult to compare savings accounts. Arguably, the most important thing you need to know is which interest rate a financial service provider is using, i.e. whether it’s the nominal interest rate or the AER. You should also find out how often interest is calculated and whether there are any administrative fees.

AER is typically used to compare the interest rates of savings accounts, as it clearly explains the overall interest you could earn. At Raisin UK, we use the AER to advertise the interest rates of all savings accounts offered by our partner banks as we believe that it provides you with a clearer understanding of how profitable a savings account is.

What are the best interest rates currently available?

The best interest rates in our marketplace are subject to change, but generally, the best bank interest rates are available on longer fixed term savings accounts. The way a bank operates a savings account could make a difference though, so be sure to read the details before applying to banks with the best interest rates.

To find the best savings account for you, compare bank interest rates on savings accounts or look for a bank, register for a Raisin UK Account and log in to apply.

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

Save smarter with the Raisin UK newsletter!

What’s in it for me?

- Receive exclusive updates on market-leading rates

- Ensure you never miss a bonus offer

- Keep your finger on the pulse with the latest financial news