The Bank of England base rate and how it affects mortgages in the UK

Why the Bank of England base rate matters for your mortgage

Anyone with a mortgage will know that it requires careful planning. That’s why any changes to the base rate can be a worry. With the Bank of England base rate already cut three times this year (as of August 2025), we’ll explore how the base rate can influence your mortgage repayments, and what to keep an eye on in the months ahead.

Key takeaways

The Bank of England’s base rate plays a key role in shaping mortgage interest rates. When the base rate falls, borrowing can become cheaper

On 18 September 2025, the base rate was held at 4% by the Bank of England’s Monetary Policy Committee (MPC)

Tracker and variable-rate mortgage holders are most likely to see changes in their monthly payments

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

What does the Bank of England base rate mean for mortgages?

The Bank of England base rate, also called the bank rate, is the interest rate that the Bank of England charges when it lends money to commercial banks. This rate has an impact on how much interest banks charge on mortgages and other forms of borrowing.

If the base rate goes up, borrowing money becomes more expensive, and if it’s lowered, borrowing is cheaper. For variable-rate mortgages, changes to the base rate can affect your payments almost right away. With fixed-rate mortgages, any changes will usually take effect only after your current mortgage deal ends.

Why does the base rate change?

The Bank of England’s Monetary Policy Committee meets every six weeks or so to decide whether to adjust the base rate. Their main goal is to keep inflation under control (at around 2%, the UK Government's current target).

If inflation is running high, the Committee might decide to raise the base rate as a way of curbing spending among consumers and businesses. On the other hand, if the economy is weak, they might lower it to make borrowing cheaper and encourage spending and growth.

Many homeowners keep an eye on movements in the Bank of England interest rates, because it could directly influence their monthly payments – particularly if they’re on a variable or tracker deal.

What is the Bank of England base rate for mortgages?

The Bank of England base rate, also called the bank rate, is the interest rate that the Bank of England charges when it lends money to commercial banks. This rate has an impact on how much interest banks charge on mortgages and other forms of borrowing.

If the base rate goes up, borrowing money becomes more expensive, and if it’s lowered, borrowing is cheaper. For variable-rate mortgages, changes to the base rate can affect your payments almost right away. With fixed-rate mortgages, any changes will usually take effect only after your current mortgage deal ends.

What is the current base rate in the UK?

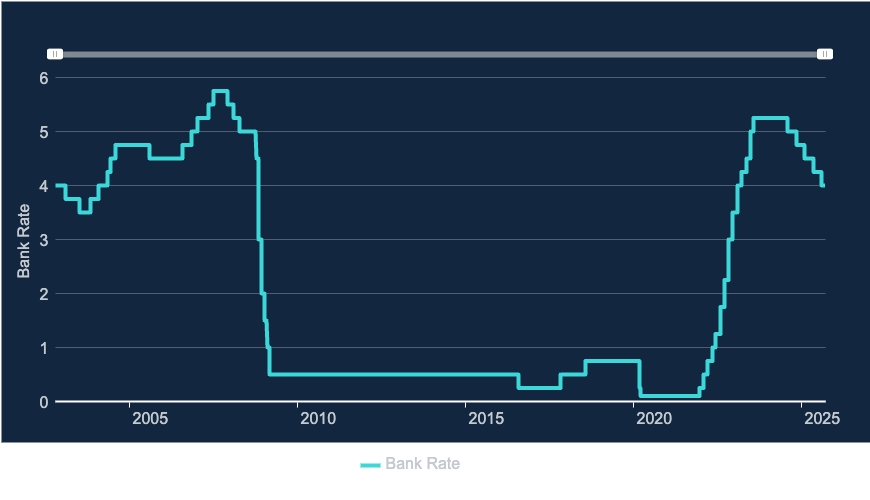

Source: https://www.bankofengland.co.uk/monetary-policy/the-interest-rate-bank-rate

The Bank of England’s base rate is now 4% (last updated on 18 September 2025). While this is the base rate, mortgage rates tend to be set a few percentage points above that.

When the base rate changes, it typically affects mortgages from the start of the following month. So if you have a variable-rate or tracker mortgage, you may receive a letter or notification in advance informing you of your new interest rate and payment.

Most lenders offer a mortgage rate calculator to show you how any changes could impact your payments.

How does the base rate affect my mortgage?

Not everyone with a mortgage will be affected by base rate changes. When the Bank of England changes the base rate, mortgage payments will usually only be impacted if they are variable.

1. Fixed-rate mortgage

With a fixed-rate mortgage, your monthly payments won’t change for the duration of the term.

Once your fixed term ends, your mortgage usually switches to a variable rate set by your lender. This might be specified in your mortgage documents, or you may be contacted a few months before your deal ends. Because the variable rate can be affected by changes to the Bank of England’s base rate, your mortgage payments could be affected too.

2. Standard variable rate mortgage

A standard variable rate (SVR) mortgage has an interest rate that can change at your lender’s discretion. It’s often influenced by changes in the base rate, but your lender can adjust the rate for other reasons too.

3. Tracker mortgage

A tracker mortgage follows the Bank of England base rate directly. Your rate is usually the base rate plus or minus a certain percentage. For example, if the base rate is 4% and your tracker deal is “base rate + 1%”, your mortgage interest rate would be 5%. If you have this kind of mortgage and the base rate goes up, your interest rate and monthly payments will also increase.

4. Discount mortgage

A discount mortgage is a type of variable mortgage that gives you a lower interest rate than the lender’s standard variable rate for a set period. The discount is usually a fixed percentage off the SVR.

If the base rate for mortgages goes up, the SVR often increases too, which means your monthly payments might rise as well, and vice versa. Keep in mind that the details can vary between lenders, so it can help to check the specific terms with your provider.

What might happen to mortgage rates in 2025?

It’s expected that mortgage rates in the UK will continue to fall throughout 2025.

The Organisation for Economic Co-operation and Development (OECD) has suggested that UK interest rates, which currently stand at 4% (as of September 2025), could fall to 3.5% in the second quarter of 2026.

Because it can be hard to predict if interest rates will rise, the Bank of England base rate could vary depending on future economic changes.

Save for a mortgage with Raisin UK

With interest rates expected to change, now could be a good time to secure a competitive fixed rate on your savings. Fixed rate bonds offer a guaranteed return over a set period, which means savings will grow even if interest rates fall.

If you want to save for a mortgage, you can quickly and easily open savings accounts with competitive rates from a range of UK banks and building societies through the Raisin UK marketplace. Register and apply today - it’s completely free!

FAQs about the Bank of England base rate and mortgages

How do current mortgage rates compare to the base rate?

Mortgage rates in the UK are now gradually falling in line with the base rate. As of August 2025, the average interest rate on 5-year fixed-rate mortgages* is 5.01% across all lenders, and 4.12% across the big six lenders.

Is a fixed or variable mortgage better when the base rate changes?

The influence of the base rate for mortgages depends on the type of deal you have.

- If you’re on a fixed-rate mortgage, your interest rate and monthly payments stay the same for a set period (for example two, five, or even ten years). Any changes to the base rate only matter for your mortgage once your fixed deal ends.

- With a variable-rate mortgage, your rate can go up or down during the term. This includes tracker mortgages, which follow the base rate directly (plus a set margin), and standard variable rate mortgages, which your lender can change at any time. In both cases, if the Bank of England increases the base rate, your mortgage payments are likely to increase.

Variable-rate mortgages like trackers might be tempting because you would benefit from the potentially falling rates. However, they come with the risk of payments increasing if rates go up.

How can I stay informed about base rate changes?

The base rate is usually reviewed every six weeks. Following updates from the Bank of England or seeing what’s next for interest rates can help you stay prepared.

Mortgage rate source

*https://www.uswitch.com/mortgages/uk-mortgage-rates-today/