What is an overdraft?

An overdraft allows you to borrow extra money from your current account. While it can be a useful way to cover unexpected costs, an overdraft is still a form of debt, so it’s important to manage it carefully.

On this page you’ll learn more about what an overdraft is, how it works and the different types. We also include some handy tips to help you keep your overdraft under control.

Overdraft definition: An overdraft enables you to spend more money than what you have in your account, but you’ll probably have to pay interest for doing so

Types: An overdraft can either be arranged/authorised (meaning you’ve agreed a set limit with your bank) or unarranged/unauthorised (you’ve made no such arrangement)

Credit score: How well you manage your overdraft could have an impact on your credit score and your ability to secure finance in the future

Overdrafts explained

Overdrafts allow you to borrow a little extra from your current account on an arranged or unarranged basis. If you find yourself with no funds in your account, you may be able to arrange an overdraft with your account provider. You can also make this arrangement in advance. An unarranged overdraft means that you can borrow that little bit extra without agreeing to it with your bank in advance. You’ll usually have to pay interest on any overdraft money you spend.

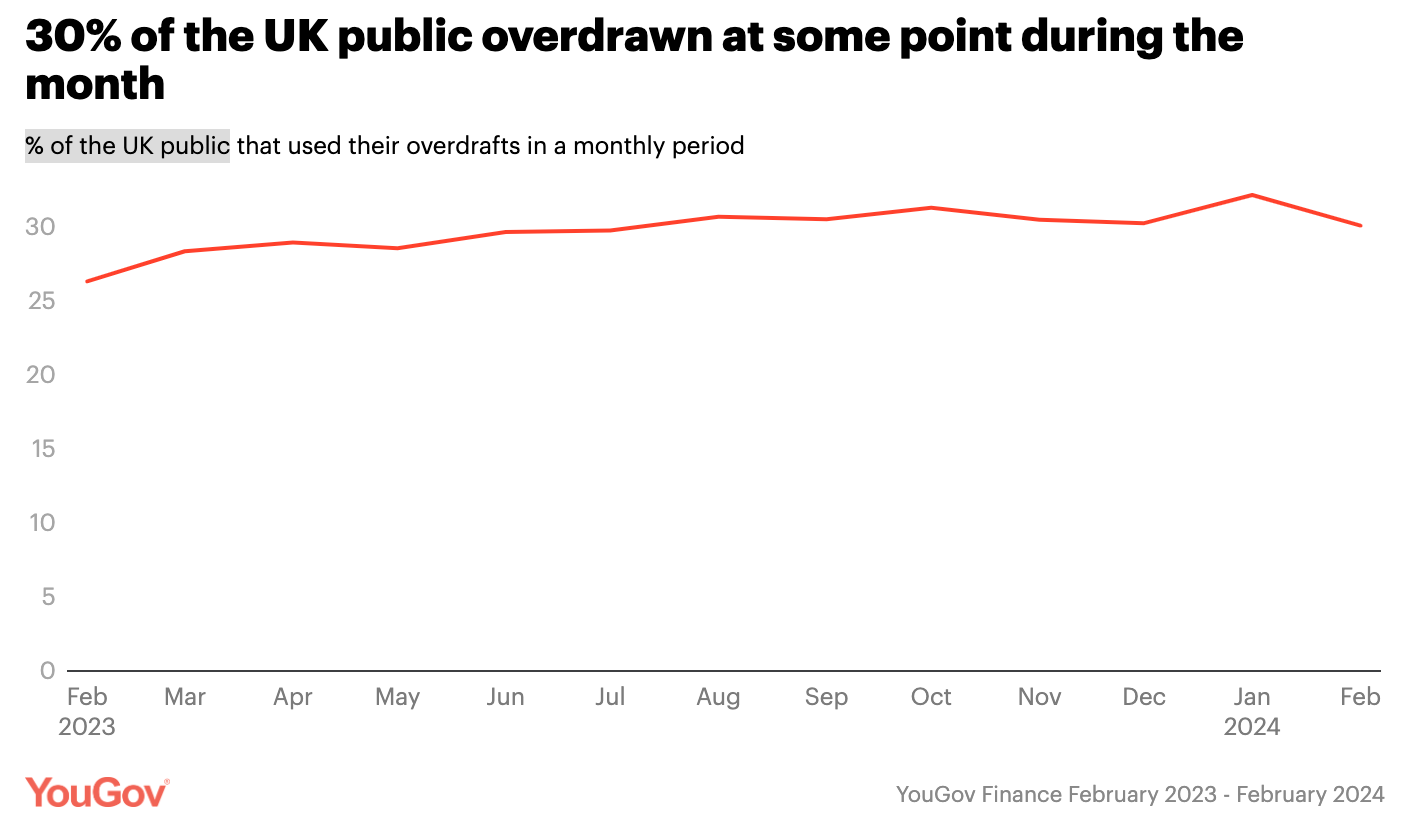

Overdrafts are big business for banks and a popular method of borrowing for customers who need to make their money stretch to payday, which can be difficult when unexpected costs come up, such as a car breakdown or a hefty vet bill.

Although the Financial Conduct Authority (FCA) clamped down on fees charged to customers by banning flat fees in 2019, overdraft charges are costing Brits an average of £697 each day, with the average customer paying £278 in interest each year to their bank in 2024.

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

How does an overdraft work?

Overdrafts work by allowing you to borrow money from your current account by taking out or spending more than you have in there. This means that if you spend more than you have, the bank will be lending you the money, and they may charge you interest for each day you don’t pay it back. For example, if your bank balance is £50, and you make a purchase of £80, you’ll have a £30 overdraft.

You can apply for an overdraft, or you might be given one automatically with your account. An overdraft is a form of debt with your bank which can either be arranged or unarranged (also called ‘authorised’ and ‘unauthorised’ – more on that below). Typically, most people using overdrafts have an agreement with their bank or lender, and this is an arranged overdraft.

Because an overdraft is a form of debt, it is repayable on demand. Always make sure you have enough money in your current account or a suitable arranged overdraft limit in place before any payments are due to come out of your account.

As an overdraft is a type of loan, it means that other ways of borrowing money, such as a personal loan, may incur less interest. It’s important to find the cheapest method of borrowing to avoid expensive or unexpected fees, or high interest rates.

Types of overdraft

There are two types of overdraft, which are the following:

Arranged/authorised overdrafts

An arranged or authorised overdraft means you set an agreed limit with your bank, allowing you to spend a little bit more money than you have. Your bank will typically charge you interest for an overdraft.

Unarranged/unauthorised overdrafts

An unarranged or unauthorised overdraft happens when you spend more money than you have in your account without agreeing to it with your bank first. This could happen if you don’t have enough to cover outgoing direct debits or where you have already exceeded your arranged overdraft amount.

Certain types of bank accounts have an overdraft built into them, such as a student or graduate account, and these may be free to use or with lower fees.

How much can I borrow with an overdraft?

An overdraft will usually give you access to funds of up to around £2,000, but how much you can borrow will depend on two things:

- Your credit score

- Your income

How much does an overdraft cost?

Major reforms to the way banks and building societies charge interest on overdrafts came into effect in April 2020. Under the new rules, banks can no longer charge more for going into an unauthorised overdraft than an authorised one. They must also charge a simple annual interest rate without additional fees or charges.

Today, interest on all overdrafts is charged at a single annual interest rate (APR), making it easier to compare overdrafts between different accounts and providers. Interest rates can vary significantly, so bear this in mind when choosing a current account.

Many banks charge somewhere between 19% and 40% APR, although some do offer low or even 0% interest rates on overdrafts for a certain period if you meet the eligibility criteria. Again, it highlights the importance of shopping around, especially if there’s a high chance you’ll need to use your overdraft.

Do I need an overdraft?

An arranged overdraft is a good option to have in case of emergencies or as a short-term solution, but they can have higher interest rates than other lending methods, such as personal loans or credit cards.

Whether or not you need a bank overdraft will depend on your personal financial situation. If you find that you’re using an unarranged overdraft frequently and getting charged for it, you might want to consider applying for an arranged overdraft with your bank or finding ways to budget your money more effectively.

How to apply for an overdraft

You can usually apply for an overdraft directly with your bank. This can sometimes be done via a mobile banking app, but you might otherwise be required to visit your local branch or call your bank. You usually can’t apply for an overdraft if you’re using a cash card.

Is it a good idea to get an overdraft?

Getting an overdraft can be useful for short-term financial issues, but it does come with high interest rates and fees, especially if you exceed your limit. While hitting your arranged overdraft is cheaper than an unarranged one, overdrafts are generally not a good long-term solution to cash flow constraints. If you're regularly entering your overdraft, it may be useful to explore other options such as personal loans or credit cards, which often offer lower interest rates.

Six tips for controlling your bank overdraft

Ensuring that your overdraft stays within the arranged limit is important. Otherwise, you may end up paying fees or charges. The following tips will help you keep control of your overdraft.

1. Keep an eye on your bank balance

Keeping an eye on your bank balance, particularly if you’re getting low on funds, is essential if you want to avoid the costs associated with an unarranged overdraft. The easiest way to do this is to sign up for online banking if you haven’t already, or sign up to receive text alerts when payments are due that may take you into an unarranged overdraft.

2. Check all letters and communications from your bank

Many people don’t open letters when they’re from the bank, as they assume it’s just routine correspondence. However, you could be missing an important message that might impact your finances. If you have online banking and opt to go paperless, these messages will be in your online inbox.

3. Use savings rather than accumulate debt

While you may wish to protect your savings, you may end up having to use them if your bank overdraft spirals out of control. It’s better to repay your overdraft before interest accumulates or before it affects your credit score. If you want to set up a bank account and can’t decide between a savings or a current account, you might want to weigh up exactly what your aim of using the account is.

4. Pay off existing debts

If you have an overdraft, credit card or other debt, you might want to consider which one is costing you more in terms of interest and charges and try to pay that one off first.

5. Draw up a budget plan

If you often spend more than you earn, an effective budget plan can help you visualise your finances and make necessary cuts. These could include things like unused subscriptions and any excessive living expenses. Ultimately, an effective budget plan can help you pay off your overdraft and live debt-free.

6. Change banking providers

If you find that your overdraft charges are higher than those levied by other banks, you might want to consider switching banks.

How is a bank overdraft paid back?

A bank overdraft is paid back when you deposit money back into your debit account. The bank will automatically reduce the overdraft balance if the funds are available. If you have an arranged overdraft, you may have agreed upon repayment methods, and the bank might charge interest on the outstanding amount. If you go past your overdraft limit, any charges or fees will typically be added to the balance, increasing the overall amount you owe. It's important to pay off the overdraft as soon as possible to avoid the accumulation of fees and interest over time.

Can I switch banks if I’m in my overdraft?

Yes, you can normally still switch banks even if you’re using your overdraft by using the Current Account Switch Service, which most banks subscribe to. Your overdraft and any corresponding debt will be transferred to your new savings account.

How do I know if I’m being charged unfairly for my bank overdraft?

If you’ve been charged fees you think are unfair or if you’re struggling to pay them, you might be able to get them back. As a first port of call, you might want to contact your bank to challenge the bank charges. Some banks write charges off as a gesture of goodwill.

While reclaiming bank charges was made slightly more difficult by a Supreme Court Ruling in 2009, it is still possible, providing you have the time to make some calls and maybe write a letter. You could even get free assistance from the Financial Ombudsman Service, providing you meet the following criteria:

- You’re seriously struggling financially. This could involve having lost your job and not being able to pay bills.

- The charges are unfair and disproportionate. For example, if you went overdrawn by £5 and were charged £40.

- You’re unable to get anywhere because you’re stuck in a spiral of charges. You’re constantly in the red because you can’t afford to pay off both the charges and the overdraft.

Find out more about current account charges and the Financial Ombudsman Service.

Is it bad to be in your overdraft?

An arranged overdraft is unlikely to impact your credit score, providing you don’t go beyond your overdraft limit or have payments refused. In fact, if you use your overdraft sensibly and regularly pay it off, this could potentially improve your credit rating.

An unarranged bank overdraft may go against your credit score and negatively impact your ability to secure a loan or mortgage in the future.

The importance of an emergency fund

Overdrafts can be a useful way to cover short-term unexpected costs, such as urgent car repairs or a large vet bill. However, it’s important to remember that most banks will charge interest (sometimes as much as 40%), making them an expensive form of borrowing.

A more cost-effective way to cover unexpected financial emergencies is to set aside a dedicated pot of cash you can call upon should the need arise. An emergency fund – also known as a rainy day fund – is a great way to cover large, unexpected expenses without the need for a costly overdraft or other debt-accumulating loan.

If you’re thinking of starting an emergency fund, opening an easy access savings account might be a good option. These types of accounts are the most flexible of all savings accounts, meaning you can safely stow away your money and access it whenever you need to.

You’ll find a great range of competitive easy access accounts on the Raisin UK website, all of which are protected by the Financial Services Compensation Scheme (FSCS) up to £85,000 per person, per bank for peace of mind.

Save smarter with the Raisin UK newsletter!

What’s in it for me?

- Receive exclusive updates on market-leading rates

- Ensure you never miss a bonus offer

- Keep your finger on the pulse with the latest financial news