Open banking explained

You’ve probably heard of open banking, but you might not completely understand what it is and what it could mean to you. Open banking is a relatively new financial service, so don’t worry if you’re not entirely sure of how it works. On this page, we’ll explain what open banking is, how it works, how open banking affects UK bank account holders and if you should consider using open banking services.

Full control: open banking gives banks and lenders access consumers’ data, but only with their explicit consent

Personalised banking: the aims of open banking are to give you more power over your finances and allow lenders to offer more tailored services

Safety first: open banking is a safe, government-led service regulated by the Financial Conduct Authority (FCA)

What is open banking?

Open banking is a practice that allows banks and third-party financial service providers, such as budgeting apps and cash flow management tools for businesses, secure access to your banking and other financial data.

Open banking in the UK is regulated through the Payment Services Regulations 2017, which brings the second EU Payment Services Directive (PSD2) into law. Open banking and the PSD2 allows banks to share your financial data, such as your account details, regular payments, savings statements and other banking information, with authorised financial service providers, as long as you permit them.

By registering for a Raisin UK Account you can get a taste of how open banking works in a safe, risk-free environment. While we don’t offer a complete open banking experience, through our marketplace, you can apply for savings accounts from a range of banks in one place and gain full financial visibility of all your accounts.

How does open banking work?

Once you’ve granted permission, your financial data can be made available by one financial institution or a third party to another through an Application Programming Interface (API). This API technology provides a secure, quick way for them to share your data.

For example, you might connect your bank account to a budgeting app that analyses your spending. Because the budgeting app can see and interpret your spending habits, it can then recommend financial products, such as savings accounts that might help you grow your savings. Open banking can also make it easier and quicker to pay bills, send money and shop online.

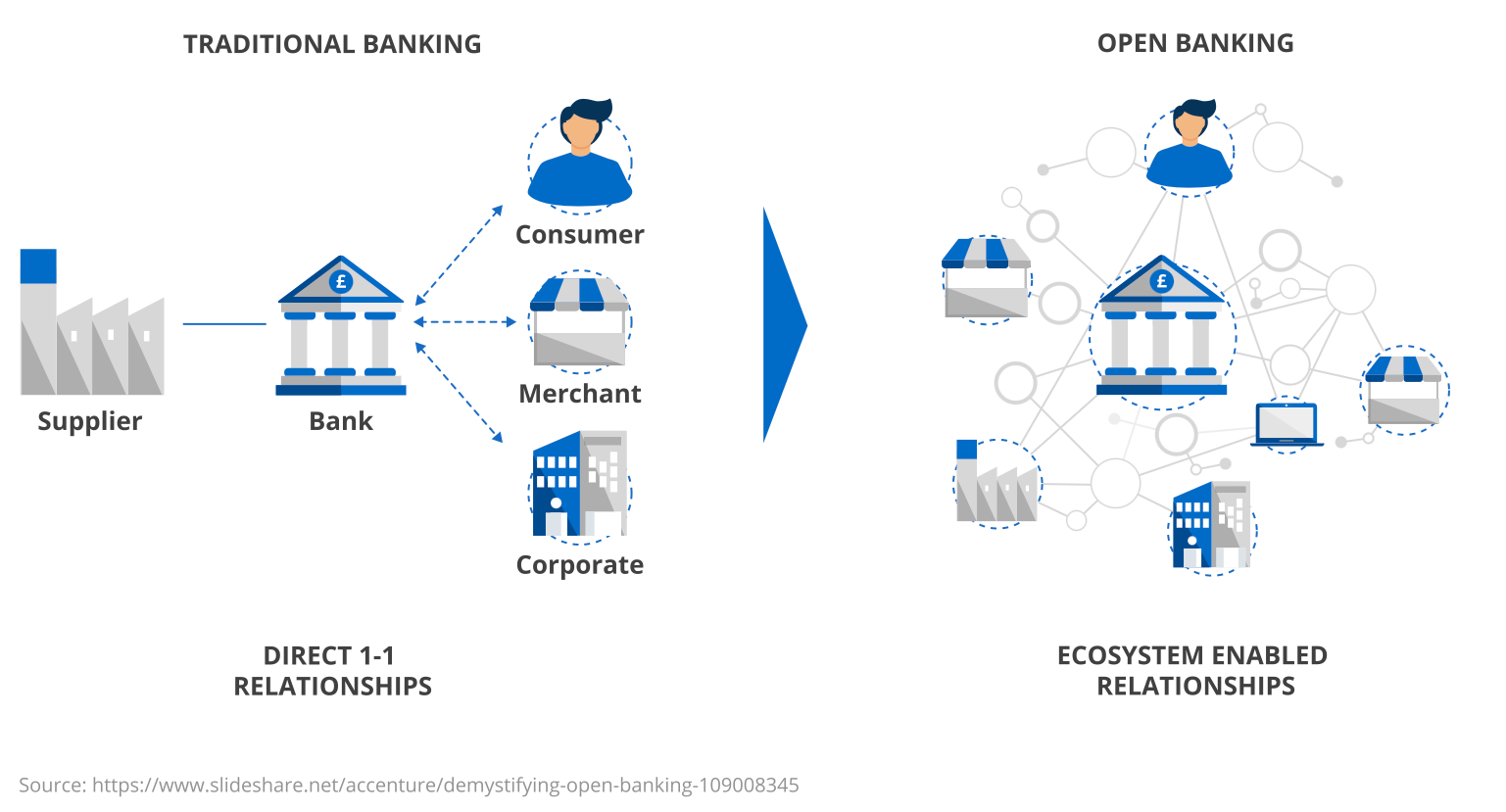

Here's how open banking is different to traditional banking:

What information will open banking companies be able to access?

You can use open banking for payment accounts that you access online. This might include current accounts, credit cards, e-money accounts and flexible savings accounts. Once you’ve given your permission for an open banking company to access your financial data, they’ll then be able to see information such as:

- Your account details, including the name on the account and your balance

- Regular payment details, such as who you’re paying, direct debits and standing orders

- Incoming and outgoing payments

- Account features including fees, rewards and overdraft payments.

- You can also authorise open banking companies to make payments from your bank account.

It’s worth remembering that open banking companies should only request permission to see the information they need to provide the particular service they’re offering. It’s important to remain vigilant so if something doesn’t feel right, it’s probably best not to share your data.

Why do we need open banking?

Ultimately, open banking should streamline financial processes, making them quicker and more effective, helping those who take advantage of open banking to manage their finances better.

The main reason you might want to take advantage of open banking is that it could help you manage your money more effectively. If you have accounts or take advantage of the financial services from different institutions, open banking could allow you to view and access all your accounts in one place at the same time.

Open banking might also be useful if you’re applying for a loan or credit card, as it could be used by lenders to see whether you meet their eligibility criteria by viewing your income and outgoings.

Online payment systems are becoming increasingly complex, which, of course, is a good thing from a security point of view. Through open banking, retailers and service providers could receive payments directly and instantly from your bank account rather than through a payment provider such as MasterCard or Visa.

What are the benefits of open banking?

The open banking initiative aims to provide many benefits to both consumers and lenders. For the consumer, the benefits include the fact that financial services are tailored specifically to your needs, and you can take control of your finances with up-to-date facts, figures and spending information.

For lenders, they can better able to protect vulnerable consumers by putting in payment blocks, identifying harmful spending patterns and taking a point of contact for a family member or friend. Additionally, having a 360° insight into consumers’ finances allows lenders to offer more appropriate products and services.

Is open banking safe?

Open banking is regulated, meaning that it’s safe to take advantage of open banking services, as long as you only give explicit authorisation for your data to be shared between UK-regulated financial service providers. Put simply; financial service apps will only be able to access your financial data if you’ve actively consented for them to do so.

All open banking service providers must also comply with data protection rules, including always indicating exactly what data will be used, how long it’ll be used for, and any actions they may need to take before you sign up.

If you’re unsure or if a financial service provider doesn’t make things clear, it might be best not to share your data. As with online banking, scams do exist, and scammers may try and trick you into opening up your data. You can also check whether a provider is regulated on the UK Open Banking Directory.

The most important thing to remember when using open banking is that you shouldn’t share your login details or passwords with anyone. Should anything go wrong with a transaction using open banking, your bank should be able to help you get a refund.

How does open banking affect UK bank account holders?

Open banking may make managing our finances quicker and easier. In fact, open banking has the potential to change the way we use banks. In the future, open banking should give UK savers by giving you more ways to access and view your savings at any time, as well as making it easier to compare and switch to different types of savings accounts. It may also help track variable interest rates, allowing you to manage your accounts better and make the most of your savings.

Should I use open banking?

Using open banking is a personal choice. If you feel uncomfortable using third-party apps to manage your finances, open banking may not be for you. However, if you’re looking for a way to manage your money and be more in control of your finances, open banking might be beneficial. As always, you should thoroughly research every product or service before you give consent to sharing your financial data.

Get a taste of how open banking works

If you want to get a taste of how open banking works in a safe, risk-free environment, register for a Raisin UK Account. While we don’t offer a complete open banking experience, through our marketplace, you can apply for savings accounts from a range of banks in one place and gain full financial visibility of all your accounts.

All you need to do to open a savings account is register for a free Raisin UK Account, click apply and transfer your deposit. There’s no need to fill out a new application each time you apply, and eligible deposits are protected from the moment they arrive in your Raisin UK Account to when they transfer to a partner bank and back again.

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

Save smarter with the Raisin UK newsletter!

What’s in it for me?

- Receive exclusive updates on market-leading rates

- Ensure you never miss a bonus offer

- Keep your finger on the pulse with the latest financial news