How to invest in REITs in the UK

Home › Investments › REITs

Property has long been seen as a stable method of investing, with “bricks and mortar” often quoted as the best option for those looking to invest their money safely. Because of this, REITS, or real estate investment trusts, have become increasingly popular since being introduced into the UK in 2007.

In this article, we answer common questions such as, “what is a REIT?” and “how do REITs work?”. We also explain the benefits and risks of this type of investment and consider the alternatives to REITs, including stocks and fixed rate bonds.

Definition: A real estate investment trust (REIT) is a type of investment company that generates money for its investors through property

REIT types: There are different types of REITs, with mortgage and equity REITs being the two most commo

Risks: While REITs can deliver good returns, the value of your investment could fall if the housing market dips or there’s an unexpected shock to the economy

What is a REIT?

Even if you already have some experience of investing, you might find yourself asking, “what is a REIT?” Put simply, a real estate investment trust, or a REIT, is a type of investment firm that makes money for its investors through property. Both individual investors and companies can pool their money together to purchase property assets, and then benefit from increases in value and rental income.

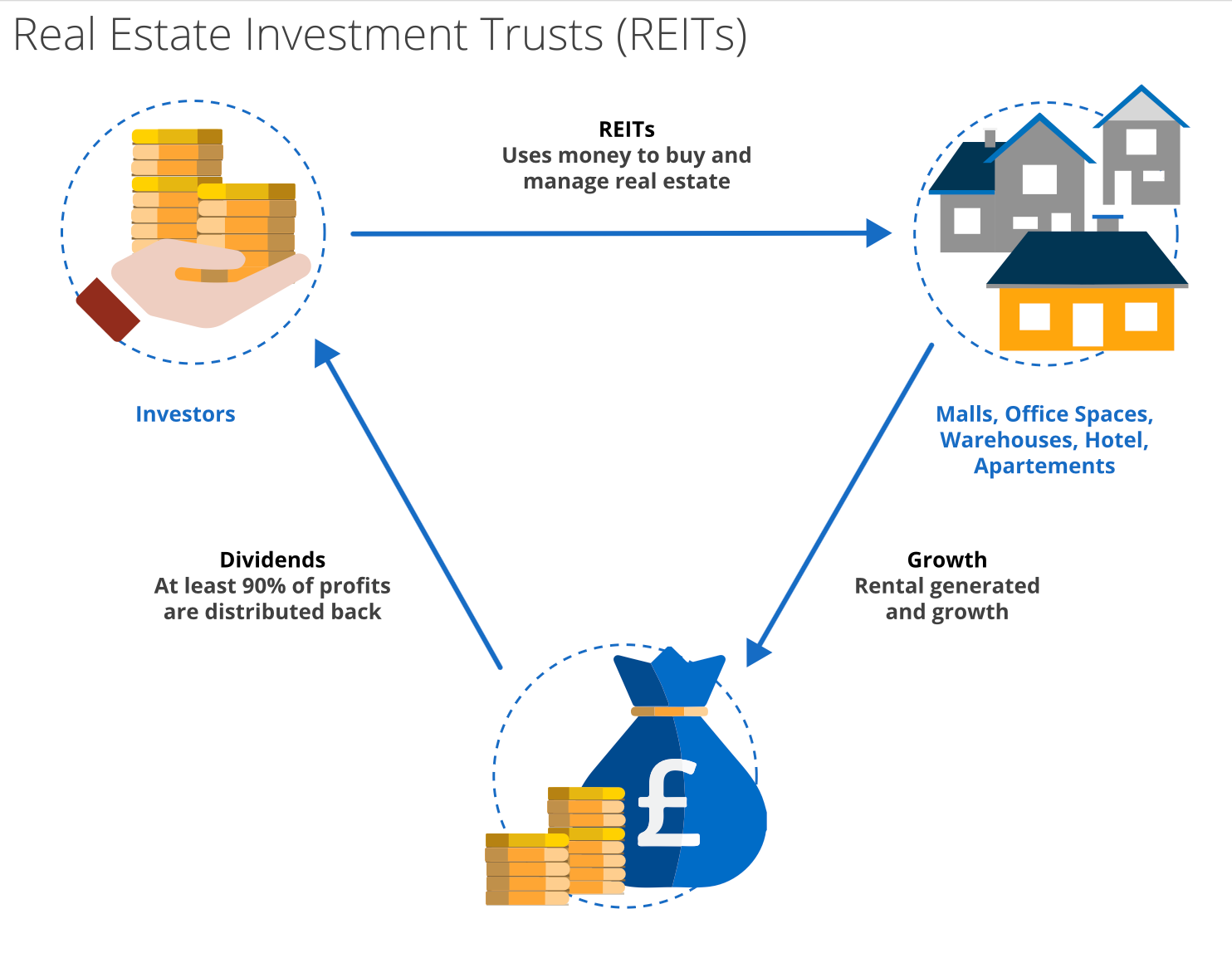

Here’s a good illustration of what a REIT is:

REITs are exempt from corporation tax on profits generated from rental income and the income from the sale of rental properties, making them a tax-efficient investment choice.

Originally established in the US in 1960, REITs were eventually introduced in the UK in 2007, with the hope of fueling speculation and real estate sector growth. This was a decision so popular that most major property-linked companies became listed as REITs.

Another way to think of REITs is like a mutual fund, but rather than investing in stocks, they invest in properties. REITs allow you to invest in a group of properties through a single investment, while the entire trust is managed by a large-scale ETF (exchange traded fund) provider that will invest in several property types on your behalf.

Investing in a REIT means you benefit from the same revenue streams as a traditional real estate investment yields, such as price appreciation and rental income. Investing in a REIT is passive, but it also allows you to invest a relatively small amount of money.

To qualify as a REIT, companies have to:

- Invest more than 75% of their assets in different types of property

- Earn more than 75% of their gross income from rent, mortgage interest or income from property sales

There are over 50 qualified REITs listed on the London Stock Exchange with a combined value of approximately £58 billion.

What is ‘real estate’ for the purposes of a REIT?

With real estate investment trusts, property falls into three categories. These real estate categories are residential REITs, commercial REITs and industrial REITs. These types of real estate can include anything from shopping centres and student housing to hotels, resorts and rental properties, among others.

What are the different types of REITs?

REITs can be split into two categories in terms of what they invest in, which are:

- Equity REITs

- Mortgage REITs

Equity REITs are funds that own physical properties and earn money from renting them to individuals or businesses. The income they earn is paid out to shareholders in the form of dividends. Normally publicly traded, equity REITs can include companies involved in residential, commercial or hospitality real estate.

Mortgage REITs, or mREITs, are funds that buy mortgages or mortgage-backed securities. They earn income from the interest on the mortgages they invest in.

While mortgage and equity REITs are the two most common, there are a number of other real estate investment trust categories that correlate to specific types of properties, such as:

- Healthcare REITs: hospitals, medical office buildings, doctors’ offices, care homes

- Office REITs: skyscrapers, business parks, government buildings

- Residential REITs: student housing, apartment complexes, family homes

- Industrial REITs: warehouses, distribution centres, e-commerce properties

- Retail REITs: shopping centres, power centres, grocery stores

- Infrastructure REITs: telecommunication towers, energy pipelines, wireless infrastructure

The chart shows how real estate investment trusts are structured:

How do REITs work?

The two ways REITs make money and, in turn, benefit their investors, are as follows:

- The price of the REIT share increases

Rental income increases, meaning they can pay out higher dividends

It’s important to remember that REITs are not without risk, because rent payments are made by companies, and these companies could default. A good example of this would be how the COVID-19 crisis affected different types of REITs. While healthcare REITs stood to benefit from the increased demand for hospitals and vaccination centres, many retail REITs suffered huge blows due to the rise of online shopping and closure of high street stores. As we explain later on, you can mitigate this risk by putting at least some of your money into safer investments and competitive savings accounts like fixed rate bonds.

REITs are easily accessible through ETFs, or exchange traded funds. ETFs mean you can invest in a group of assets in just one transaction. These assets could contain anything from shares, commodities like gold and oil and, of course, real estate.

In the case of real estate, the ETF provider will pool funds from different investors, bringing the total up to millions – or potentially billions – to invest in real estate and generate income. You, as an investor, will receive the benefit of this through dividends paid on a regular basis.

A term you might come across frequently when investing in REITs is ‘NAV’. NAV stands for net asset value, which is the value of everything contained within the fund minus any outstanding payments or debts.

For example, if a REIT holds £100 million in property but has £15 million in mortgage debts, the total NAV is £85 million. It’s essential to know and understand the NAV of a REIT in order to track its performance.

Cashing out of real estate investment trusts in the UK

While REITs are best when committed to long term, there is an option should you need access to your cash. If you want to raise funds from your REIT, you can exit your position and sell it for the current stock price of the real estate ETF, which is derived from the NAV.

How to invest in REITs

There are two options for you if you’re looking to invest in REITs, which are as follows:

- Investing in the REIT itself

- Trading on the price movements of the REITs

Investing in REITs

When it comes to investing in REITs, you can do this either via an ETF as we explored above, or by purchasing shares in REIT companies themselves. Investing via an ETF might be a better option for you if you’re looking to diversify your investments.

Investing in a REIT may also be a good addition to your pension portfolio, as they deliver annual dividends and are a good long-term choice, since the real estate market typically grows over time.

Trading REITs

Rather than invest in REITs, you could choose to speculate on the shares of REITs or ETFs. When you trade REITs, you can actually profit from both rising and falling prices because you don’t have to take ownership of the shares. To do this, you’d need a spread betting or trading account and would need to do your own research, as this type of investing can be extremely risky.

Where to find REITs

There are several investment platforms which allow you to access and invest in REITs, although we would always recommend that you fully understand at least the basics of investing beforehand.

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

Benefits of investing in REITs

Just like other types of investments, REITs can bring many benefits. Some of these benefits include:

- 90% of REIT income goes on dividend payouts to investors who don’t have to pay income tax

- REITs are often consistent in terms of income and market performance

- They can be a relatively safe option if you want to diversify your portfolio

- They earn you a passive income

- Investing in foreign properties alone can be overwhelming, but a REIT can give you access to a global market

- No expertise of real estate is actually needed to invest, the REIT provider has it all

- You could be contributing to something positive, such as healthcare properties

- REITs can be a good choice for those in it for the long haul, with most property appreciating over time

- You can start your REIT investment off with only a small amount of money, because some platforms allow you to invest with as little as £50

Risks of investing in REITs

As we explored above, REITs have many benefits. However, they do also carry risks and other factors you should consider before investing. These include the following:

- Your money is in someone else’s hands while it is being invested. Unlike shares, you won’t get a say in where the money goes.

- REITs are subject to unforeseeable economic disruptions, such as the coronavirus crisis.

- Regional housing markets and their individual price fluctuations should also be factored in, because this will affect your investment.

If you’re more risk-averse, you might want to consider growing your wealth by opening a high-interest savings account instead. Savings accounts like fixed rate bonds pay competitive interest rates and provide a guaranteed return without the risks associated with REITs or some other types of investments. Plus, if you save with a UK-regulated bank, up to £85,000 of your money is protected by the Financial Services Compensation Scheme (FSCS).

Should I invest in a real estate investment trust?

Whether or not you should invest in a real estate investment trust depends on your appetite for risk and whether you can afford to lose money if the housing market dips.

As with all other types of investing, it might be best if a real estate investment trust makes up part of a diversified portfolio, as a way of protecting you from financial shock and unexpected disruptions to the market. This could mean spreading your money across other investments like shares, ETFs, bonds and fixed rate savings accounts. You can read more about some of the different options below.

What are the alternatives to REITs?

If you want to grow your money but don’t think a REIT investment is right for you, there are various alternatives available. Here are just some of the options you might want to consider, although if you’re in any doubt, speak to a financial advisor before taking action.

Stocks

Investing in the stock market can be an effective way to grow your wealth over the long term. However, as with REITs, there are risks involved and you could potentially lose some or all of your original investment. If you are considering this option, our guide to the stock market covers everything you need to know to get started.

Another question you could well be asking yourself is, “which is a better investment, REITs or stocks?”

In terms of inflation and interest rates, it could be argued that stocks are a riskier option. This is because when interest rates rise, share prices fall, causing stock traders to short sell their stocks out of worry that prices won’t rise again in the future.

REITs, on the other hand, react in the opposite way. Their prices rise with interest rates, rather than fall. Economic growth helps boost the value of REITs, and, in turn, your earnings.

Bonds

Investing in bonds works in a similar way to taking out a loan. When you buy bonds, an institution, such as the government, or company is effectively borrowing money from you with an obligation to pay it back with interest. Buying bonds is generally considered safer than investing in REITs or stocks and shares, however, the returns tend to be much lower.

Property

You could choose to invest in property using other methods which come with lower risks. For example, if you have a large lump sum to invest, you may want to consider buying a property and then renting it out to secure a regular monthly income.

Alternatively, if you have a spare room in your existing home, you could take in a lodger. The rent-a-room scheme allows you to earn up to £7,500 a year tax-free (£3,750 if you share the income with someone else), making it a tax-efficient way of generating some extra income.

Grow your wealth with Raisin UK

Although we don’t currently offer REIT investments, you’ll find a wide range of high-interest savings accounts in the Raisin UK marketplace.

Our fixed rate bonds offer competitive interest rates that don’t change from the day you open the account until the end of your term. Plus, all of the savings accounts in our marketplace are covered by the Financial Services Compensation Scheme (or European equivalent), giving you peace of mind that your money’s safe and secure.

To quickly and easily open a savings account with one of our partner banks, simply register for a free Raisin UK Account and apply for your chosen account today.

Save smarter with the Raisin UK newsletter!

What’s in it for me?

- Receive exclusive updates on market-leading rates

- Ensure you never miss a bonus offer

- Keep your finger on the pulse with the latest financial news