Teachers’ pensions in the UK: a guide

As one of the benefits of being a teacher, teachers working in a state-funded school in the UK will automatically enrol in the Teachers’ Pensions Scheme (often abbreviated to 'tps pension'). This scheme can ensure a stable financial future, but it can be complicated to understand, making planning for retirement confusing. On this page, we clarify everything you need to know about teachers’ pensions and provide insight into how they work. We also look at other options you might want to consider, such as investing and high-interest savings accounts.

Teachers’ Pension: The Teachers’ Pension Scheme is a type of pension scheme designed only for teachers

Retirement income: You’ll receive a retirement income based on what you earned when you joined the scheme

Contributions: Your employer also makes contributions, and the government provides tax relief on your contributions

What is the Teachers’ Pensions Scheme?

If you’ve dedicated your working life to the teaching of others, you’ll be entitled to a pension known as the Teachers’ Pension Scheme, that pays you an income when you retire.

The income you’ll receive depends on your earnings over your career as a teacher. On the 1st April 2015, a major change affected the Teachers’ Pension Scheme. This change affected how much you’ll receive when you claim your pension, calculating the amount based on when you joined the scheme. Following further changes that came into effect in 2022, all active members (including those in final salary schemes) will now build up their pension benefits in the career average scheme.

How does the Teachers’ Pensions Scheme work?

Every time you get paid during your employment as a teacher, you’ll pay a percentage of your gross salary into a pension. Your employer also makes contributions, and the government assists you by providing tax relief, which means you don’t have to pay tax on your pension contributions. The Teachers’ Pension Scheme is a Defined Benefit Scheme registered under HMRC.

As a teacher, the pension you’re entitled to depends on your salary and length of service, rather than investments, as is the case with some pensions. The good news is this means you won’t have to worry about stock market fluctuations. When you claim your tps pension, you can either use it as a regular source of income or withdraw some of it as a tax-free lump sum.

How long do you have to work to get the full teachers’ pension?

To receive benefits from the Teachers’ Pension Scheme, you’ll need to have two years’ pensionable service after 5 April 1988 or five years of pensionable service that was completed at any time. Your service record can relate to a final salary scheme, career average scheme or a combination of both.

Teachers pension contributions add up, but ultimately, the amount of pension you’ll receive depends on which scheme you’re in, your pensionable earnings (either your salary at retirement or your average salary over your membership), and your pensionable service (how long you’ve been a member of the scheme).

Do teachers get the state pension as well as the teachers’ pension?

Yes, teachers' pensions contributions mean they are entitled to claim the state pension as well as their teachers’ pension.

The amount of state pension you receive might be different if you were a member of a defined benefit (final salary) Teachers’ Pension Scheme between 1978 and 1997. In this case, you may be entitled to additional payments as part of the Guaranteed Minimum Pension (GMP). The GMP only applies to state scheme members who were contracted out automatically by their pension scheme.

Under the GMP rules, the government will pay all pension increases with your state pension for service up to 5 April 1988. For service between 6 April 1988 and 5 April 1997, pension increases (up to 3%) are paid by the Teachers’ Pension Scheme. The balance is paid by the government with your state pension.

Which pension scheme am I in?

As a teacher, the type of pension scheme you’re enrolled in and how much you’ll receive will depend on when you joined the tps scheme and how many years away from retirement you were on the 1st April 2015.

Your enrollment date determines whether you’ll receive an income based on either your final salary or your career average earnings. Some people will remain in the final salary scheme, while others move to the career average arrangement. Furthermore, different career average arrangements are in place for those closest to retirement. These arrangements are:

- Protected scheme member: You’re in the final salary scheme, i.e. you’re ‘protected’ if you were an active member before 1 April 2012, and you were 10 years or less away from acquiring your normal pension.

- Tapered scheme member: You’re a tapered member in the final salary scheme if you were an active member before 1 April 2012, and were between 10 and 13.5 years away from your pension age (but see changes below).

- Transition scheme member: You’re a transition member in the final salary scheme if you were more than 13.5 years away from your pension age when you enrolled, meaning you’ll have entered the career average arrangement on 1 April 2015 (but see changes below).

- New scheme member: You’ll be a career average arrangement member if you joined the Teachers’ Pension Scheme after 1 April 2015.

What is the Teachers' pension career average scheme?

Some important changes to the transitional protection rules came into effect from 1 April 2022. Under the reforms, the final salary scheme closed for new contributions on 31 March 2022 and any members still contributing to that scheme were moved to the career average scheme.

This means that if you’re still an active member of the Teachers’ Pension Scheme, you’ll now be in the career average scheme only. The salary link will still apply if you have service in the final salary scheme (unless there’s a break of more than five years). You can see whether you’re affected by the recent changes by visiting the Teachers’ Pensions website.

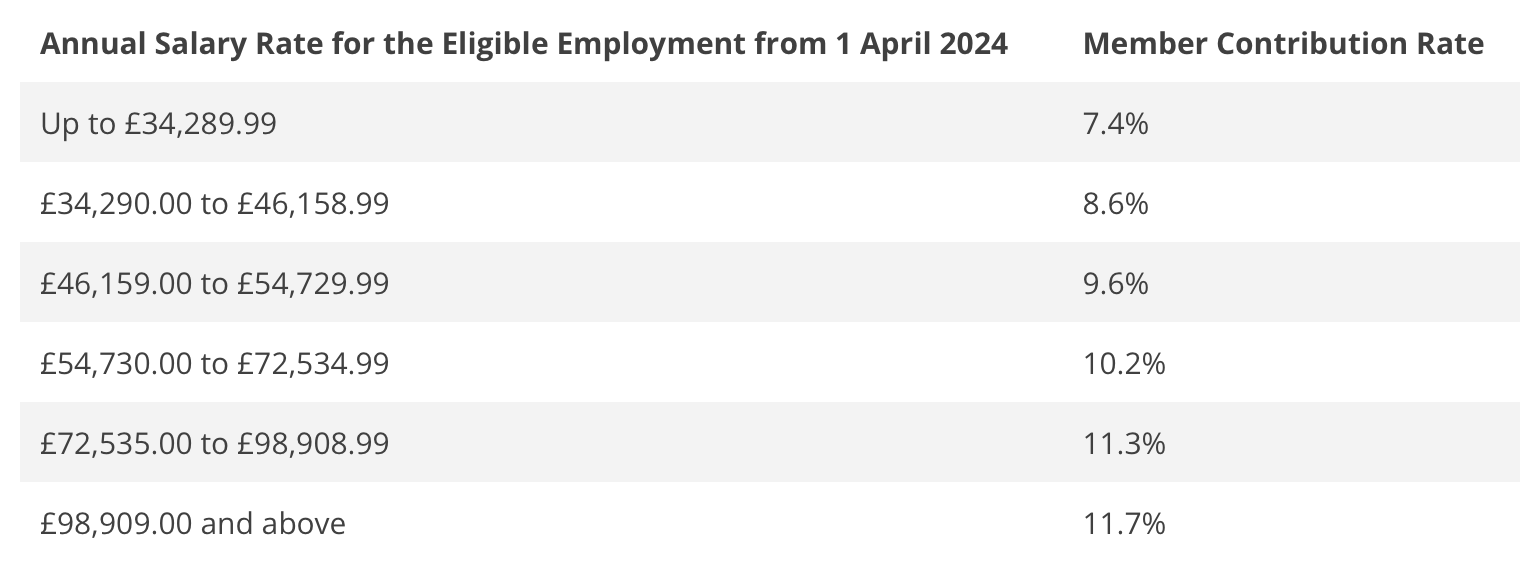

How much do I contribute to my Teachers’ Pensions Scheme?

Full-time and part-time teachers pay a percentage of their gross salary into their pension scheme each month, and this amount depends on how much you earn. The amount you’ll contribute in 2024/25 is as follows:

Does my employer have to match my pension contributions?

Your employer contributes the equivalent of 23.68% of your pay towards the cost of the benefits provided. The employer contribution rate has remained unchanged since 1 September 2019. Employer contributions are based on the pensionable earnings paid to you in the pay period.

How much is a teacher’s pension in the UK?

How much your annual pension as a teacher will be is calculated by multiplying your average salary by your years of service, then dividing it by 80. That means for a teacher employed full time and retiring when they are 60 with an average salary of £30,000, your pension will be £30,000 x 25 / 80 = £9,375 per annum.

If you retire at age 55, your pension will be £9,628.77 x 0.796 = £7,664.50, with a lump sum of £22,993.50.

However, the amount you’ll receive when you retire will depend on which pension scheme you’re in. If you’re in the final salary scheme, the amount you’ll get will be based on your pensionable earnings each year. Every year, you accumulate 1/57th of your pensionable earnings, including overtime. Your pension total also increases through indexation, wherein your pension is revalued so that it keeps up with inflation.

For example, if you earn £25,000 a year, you’ll earn a pension for that year which is £25,000 x 1/57 = £438.60, with indexation added at the end of the year. Adding £20 as indexation will give you a total of £458.60 in your pension pot at the start of the following year.

If you also earn £25,000 the following year, you’ll add another £438.60 to your existing pension pot of £458.60, giving you a total amount of £897.20. Indexation will then apply to your total pension amount.

If you’re in the career average scheme, the amount you’ll receive when you retire will depend on your average salary over the length of your career. When you retire, the Teachers’ Pensions Scheme will use this average to calculate your final salary benefits. An accrual rate is applied, which depends on the section of the scheme you’re in. If you retire when you’re 60, then your accrual rate is 1/80th. If you retire when you’re 65, your accrual rate is 1/60th.

To get an estimate of what your final pension might be worth, you can use the official Teachers’ Pensions calculator.

What is the average teacher’s pension in the UK?

As calculations are unique to each individual, there isn’t really an ‘average’ teachers’ pension in the UK. For example, someone who’s been a member of the Teachers’ Pension Scheme for, say, 30 years, but has never received a senior level salary, might have a lower average or final salary than a colleague who’s been enrolled for less time but has held more senior roles during their career.

What happens to my Teachers’ Pension if I have a break from teaching?

Only breaks in teaching that exceed five years affect your pension, and how it affects your pension will depend on two factors:

- What scheme you were in before taking your break

- When your break was for

If you were in the final salary scheme with a pension age of 60 and had a break from teaching for more than five years, returning on or after the 1st January 2007, your pension age will remain the same for any service completed before the break. The pension age for service completed after the break is 65.

For protected or tapered members, a break of more than five years will mean you’ll move into the career average scheme when you return to teaching.

When will I get my Teachers’ Pension?

The age at which you can access your teachers’ pension is called the ‘normal pension age’ or 'normal retirement age' and, again, it depends on the scheme you’re in. Protected members in the final salary scheme have a pension age of either 60 or 65.

Wondering when you can retire or how early you can retire? Your pension age will depend on when you enrolled in the scheme.

- If you enrolled before 1st January 2007, your final salary scheme pension age is 60.

- If you enrolled on or after 1st January 2007, your final salary scheme pension age is 65.

Tapered and transition members who benefit from the final salary scheme and career average schemes may have more than one pension age. Your pension age for the career average scheme can be either your state pension age or 65.

Why should I take out a Teachers’ Pension?

Enrolling into the Teachers’ Pension Scheme helps you save for retirement and is one of the benefits of being a teacher. People who retire without a proper pension often find it difficult to live off their state pension alone, as it can be hard to afford even the basics. If you save effectively for your retirement, you can gain more enjoyment from your pension years.

A Teachers’ Pension also offers additional benefits, such as family protection. This protection offers security for a long-term pension, and it’s in place to protect your family if something happens to you (more on that below).

The government protects Teachers’ Pensions, and you have the option to retire early (before the normal pension age), at the age of 55. You’ll also have the option to convert some of your pension into a tax-free lump sum, which can help with luxuries such as travel, paying off your mortgage, or buying a car or other big-ticket items. This is why the tps pension scheme is considered worthwhile by many.

What happens to my pension if I die?

If you die while you’re still teaching and you’re in the career average scheme, a ‘death grant’ of three times your final full-time salary will be paid to your next of kin, or the person you chose to specify in your pension agreement.

If you die while collecting your Teachers’ Pension and you’re married or in a civil partnership, your partner is entitled to receive your full pension for three months. After three months, your partner will receive your pension at a reduced rate until they die.

- If you’re in a career average scheme, your partner will receive 37.5% of the pension you earned up to your death.

- If you’re in the final salary scheme, your partner will receive 1/160th of your final average salary from each year of service.

As an example, this means that if you’ve been in the scheme for 30 years and your final salary was £30,000, your partner will receive £30,000 x 30 / 160 = £5,625 a year. Additionally, if you’ve been collecting your pension for five years or less, the Teachers’ Pension Scheme will also pay a discretionary death grant of up to five times your annual income.

If you die after leaving pensionable employment and have two or more years of pensionable service, your death grant will depend on the arrangement you’re left with. If you have a final salary arrangement, your estate will either acquire a retirement lump sum at the date of your death, or your pension contribution plus a 3% interest if there is no adult pension payable. If you have a career arrangement, you can either have an accrued pension multiplied by 2.5, or your pension contribution plus 3% interest, if there is no adult pension payable.

You can use a tps pension calculator to work out the details that are specific to you.

Alternative ways to save for retirement

You have various other options to consider when saving for retirement. You may wish to consider individual savings accounts (ISAs), which offer a tax-free way to save. You can save up to a maximum of £20,000 per tax year (traditionally 6th April to 5th April), and you can choose from different types of ISA. Bear in mind, however, that interest rates on ISAs may not be as competitive as those available on other types of savings accounts.

Another way to save is through investing, although this comes with more risks. Investing in stocks is considered a long-term strategy that can be very profitable, but your returns aren’t guaranteed, and you could stand to lose all your investments.

A safer way to save for retirement than investing in stocks is with a traditional savings account. Many savings accounts offer competitive interest rates, and you won’t risk losing your deposits, as deposits into UK-regulated banks are protected by the Financial Services Compensation Scheme (FSCS).

Boost your retirement savings with Raisin UK

You can easily apply for savings accounts with attractive rates in the Raisin UK marketplace.

Simply register for a Raisin UK Account and choose from a range of competitive savings accounts from our partner banks. Registration only takes a few minutes and it’s completely free. Plus, all of our savings products are protected under the FSCS or equivalent European Deposit Guarantee Scheme for added peace of mind.