Negative interest rates

Negative interest rates have historically been used by central banks to stimulate consumer spending during times of economic uncertainty or a recession. The good news is you can minimise the impact of negative interest rates by opening a risk-free savings account such as a fixed rate bond, which guarantees a competitive fixed interest rate for the duration of the term. Read on to find out more about negative interest rates and how they work, along with the effects and economic impact. Discover how you can potentially avoid negative interest rates by locking away your cash in a fixed rate bond.

Economic boost: Negative interest rates are sometimes used to boost the economy after a crash or recession

Savings: Negative interest rates mean low interest rates on savings

Impact: The effect that negative interest rates have on a country’s economy can vary

What are negative interest rates?

Negative interest rates mean that financial institutions may have to pay interest to borrowers instead of earning interest from them, but savers could also be affected. Unfortunately, negative interest rates aren’t a new phenomenon.

Although this practice may be unfamiliar to the British public, countries around the world have already experienced negative interest rates.

In 2020 and 2021, the base interest rate in the UK was also on a downward trajectory. Although it never reached sub-zero levels, it was set at a record low of just 0.1% for most of 2020 and 2021. However, in 2022, UK interest rates started to climb in response to soaring inflation, and as a result, rates on certain savings account began to increase. By October 2023, the base rate reached 5.25% – its highest level since 2018 - before falling slightly to its current level of 4.75% (as of December 2024).

How do negative interest rates work?

When the national base rate drops to a negative figure, banks incur a charge for holding their cash in the central bank, the Bank of England in the UK, rather than earning interest. This means banks then decide whether or not to pass this cost on to their savers.

What is monetary policy?

Monetary policy is how central banks control interest rates. Central banks operate in almost every economy in the world, controlling the cash supply for their respective economies. A central bank's primary purpose is to control inflation rather than the economy as a whole.

Keeping inflation at the optimum level of around 2% is a tricky balancing act. If everyone pumps their money into the economy and takes out loans and credit cards, inflation can rise too high, resulting in central banks increasing interest rates to control it. This is currently the case in many countries, including the UK, where the Bank of England consistently hiked the base rate each month from December 2021 in a bid to rein in inflation, taking its main policy rate from 0.1% to a 15-year high of 5.25% in August 2023 (although, as of December 2024, it has fallen to 4.75%).

If central banks increase interest rates too much, however, and nobody wants to spend or borrow because they are so high, inflation drops too low.

As a result, central banks might decide to drop their interest rates and encourage people to spend again - sometimes resulting in negative interest rates.

Which countries have negative interest rates?

Following the global financial crisis of 2008, interest rates were cut around the world. The European Central Bank (ECB), the US Federal Reserve, the Bank of England and the Bank of Japan cut interest rates to almost zero, and in June 2014, the ECB cut its rate to -0.10%. Switzerland, Sweden, Hungary and Japan later followed suit.

At the peak of the pandemic, the 19 nations in the Eurozone, along with Sweden, Switzerland and Japan, all had interest rates below zero. Although this practice may be fairly unfamiliar to the British public, this shows that countries around the world have already experienced negative interest rates. More recently, however, many central banks have started to increase interest rates in response to rising inflation.

However, with inflation currently soaring around the globe, for many countries the era of negative interest rates issuer over. In an attempt to bring down inflation, some central banks are beginning to steadily increase interest rates. In July 2022, for example, the ECB voted to raise interest rates by 0.5 percentage points to 0.0% - the first increase since 2011. It comes as inflation in the eurozone reached 5.2% in August 2023.

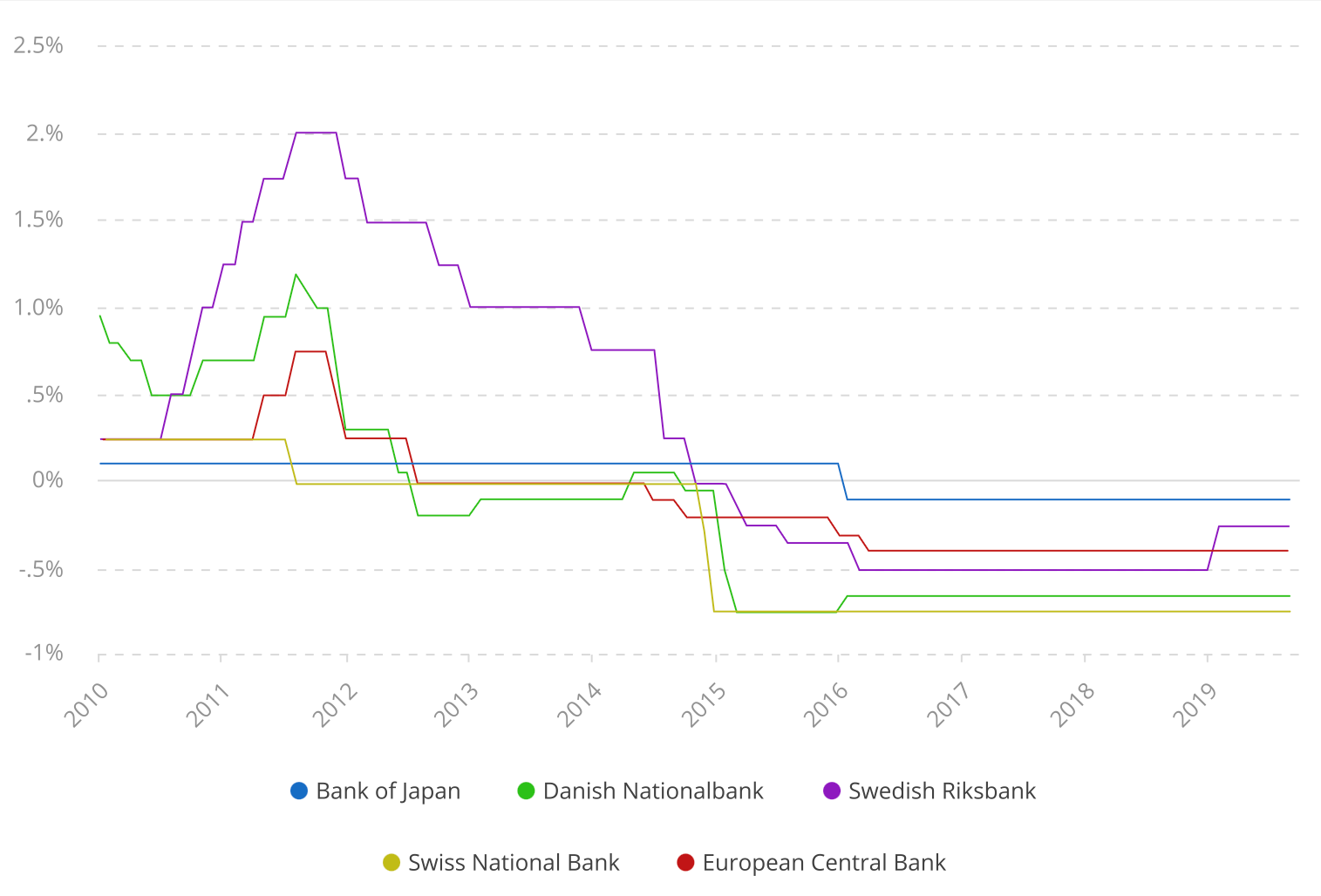

The graph below shows how banks all over the world have historically used negative interest rates to stimulate spending.

An example of a negative interest rate

While it’s commonly thought that negative interest rates are a relatively new concept, they’ve actually been around for quite some time. Negative interest rates were used as a tool to kickstart the economy immediately after World Wars I and II, the latter at a time when the causes of the Great Depression were still being explored.

Low and negative interest rates were used in both the UK and the US after World War II to pay off war debts. These interest rates, coupled with increased pressure to purchase government bonds, were used as a model for financial recovery. At the end of World War II, Britain’s government debt was more than twice as high as the GDP, and the Americans’ was almost 120% of their GDP. Ten years later, the percentages were only about half as high.

How can interest rates turn negative?

Interest rates can turn negative in times of great economic recession. Central banks in economies across the globe can make this decision to encourage populations to spend money and stimulate the market.

Why are negative interest rates being used?

Negative interest rates are an unconventional way of trying to stimulate economic growth by making it cheaper to borrow and therefore boosting spending and investment. If successful, negative rates could help prevent a global recession while easing the burden of debt that many economies are under.

The effects of negative interest rates

Negative interest rates affect the economy, and within that, consumers, borrowers and lenders, in various ways.

What are the economic effects of negative interest rates?

Negative interest rates can affect the economy in the following ways:

- Low-interest traditional savings accounts mean that savers might instead invest in the stock market to try and get a better return on their deposit, pushing stock markets up.

- In turn, this can then lead to a stock market crash.

- If there’s a recession, central banks don’t have many options left to try and stimulate the economy as there’s little scope to reduce rates further.

What are the effects of negative rates on consumers?

In theory, negative interest rates mean that consumers – both individuals and businesses – won’t earn as much interest on their savings as they once would, or the value of your savings will decrease. However, some banks have helped to ease this burden. In countries with negative interest rates, although banks may pass their costs on to savers who hold deposits with them, to date, few banks have done so.

How do negative interest rates affect borrowers?

In simple terms, negative interest rates mean borrowers benefit, while savers don’t. This is because borrowers effectively pay less back than they originally borrowed, while savers might have to pay their bank to keep their money for them. In some countries, such as Denmark, banks actually offer negative interest rate mortgages, where the investors take the hit rather than the banks themselves. The UK has ruled out these kinds of mortgages.

How do negative interest rates affect lenders?

There’s a common argument as to how negative interest rates affect lenders specifically. During times of high interest rates, cash flow usually increases, as shown in the chart below. This is because consumers take advantage of better returns, knowing they’ll earn more interest. Therefore, a counter argument against using negative interest rates to boost the economy is that they could have the opposite effect.

Do negative interest rates work?

After World War II and the 2008 financial crisis, negative interest rates proved to be a valuable tool – when used sparingly. In the wake of the coronavirus pandemic, some countries, such as the United States, opted to steer clear of adopting such methods due to the mixed evidence on whether they really work.

Who benefits from negative interest rates?

Negative interest rates are arguably seen as a tool against unprecedented economic turmoil, used to boost the economy and create a surge of borrowing by facilitating low rates on lending. The theoretical aim of negative interest rates is to benefit everyone by improving the economy.

What does negative interest rates mean for borrowers?

In theory, negative interest rates mean that savers won’t earn as much interest on their deposits as they once would, but some banks have helped to ease this burden. In countries with negative interest rates, although banks may pass their costs on to savers who hold deposits with them, to date, few banks have done so.

How to open a savings account at Raisin UK

To open savings accounts from our partner banks, you first need to open a Raisin UK Account then you can apply in just three steps:

- Log in to your Raisin UK Account

- Click to apply for a savings account

- Transfer your deposit

Once your application is approved, simply deposit your savings and start earning money straight away.

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

Save smarter with the Raisin UK newsletter!

What’s in it for me?

- Receive exclusive updates on market-leading rates

- Ensure you never miss a bonus offer

- Keep your finger on the pulse with the latest financial news