4.40%

AER

Fixed rate bond

United Kingdom

(AA)

Sharia account

Home › Investments › The best way to invest £100k

If you’ve recently inherited money, received a redundancy package or have freed up some cash to make an investment, you might be asking yourself the question, “what is the best way to invest £100k?”

The good news is there are plenty of ways you can generate a good return on a £100,000 lump sum – you just need to know your options.

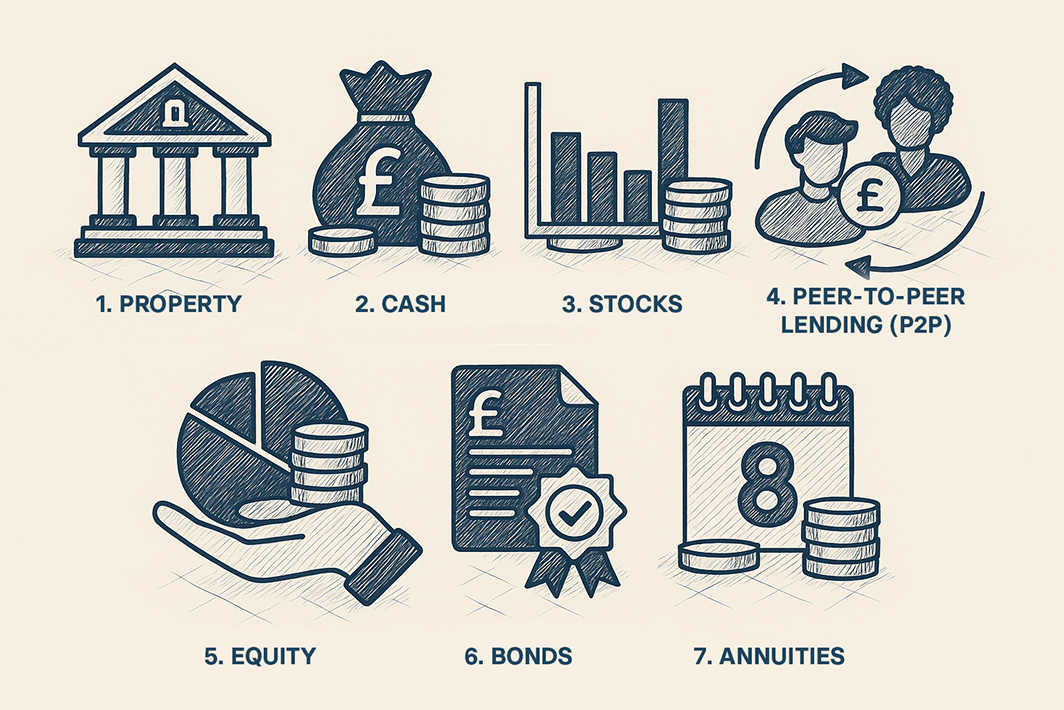

This article explores how to invest £100k and the best and safest places to put your money, including stocks and shares, property, P2P lending and fixed rate bonds.

Investing £100k: Some of the best ways to invest £100,000 include investing in property, the stock market, P2P lending and opening a fixed term savings account.

Expert advice: If you’re new to investing, speak to a financial adviser. They can help you build an investment portfolio that meets your needs and appetite for risk.

Investing safely: One of the safest ways to invest £100k is to split the cash across savings accounts with different banking groups, thereby ensuring the entire sum is protected by the FSCS.

The information provided here is for informational and educational purposes only and does not constitute financial advice. Please consult with a licensed financial adviser or professional before making any financial decisions. Your financial situation is unique, and the information provided may not be suitable for your specific circumstances. We are not liable for any financial decisions or actions you take based on this information.

If you have found yourself in the rather nice position of wondering what to do with £100,000, it’s important to consider all your options and possibly even seek independent financial advice, especially if there’s anything you’re unsure about. The best way to make a worthwhile return on your money could be by choosing to invest in one or several different assets, and one of these may be the best place for you to save £100k.

An asset is anything of value that can be converted into cash. This could range from a share in a company through to home goods such as a television. Both businesses and individuals have assets, which in turn contribute to the financial health and net worth of that person or business. An asset typically generates income, particularly in the form of property or stocks and shares.

If you’re wondering how to go about investing your £100,000, you’ll first need to know a little investing jargon. Firstly, an ‘investment vehicle’ is any method or product used by investors to gain positive returns, or another name for an asset. In simple terms, it’s somewhere to put your money which should earn you even more money – it drives your earnings forward, which is why it’s called a vehicle.

But how do you know what to do with £100k in the bank? Following are the types of assets you could consider investing in with your lump sum.

To determine the best asset to invest in, you’ll first need to think about how much return it could generate, as well as the amount of risk you’re comfortable with. We’ve explored some different types of assets worth considering below:

Property is seen as one of the safest forms of investment in the UK, especially in the buy-to-let market. But while the returns that landlords and developers get from property is usually not related to investment markets, it doesn’t mean they are entirely risk-free. This is because the housing market is still subject to price corrections and crashes, with some financial experts warning that house prices could slump following the recent sharp rise in mortgage interest rates.

As well as this, you’ll need to offset your earnings against any capital gains tax and income tax due as a result of your investments in property. With the buy-to-let tax relief decrease, investing in property may only provide optimum returns when you have next to no mortgage.

Cash is often the first thing that comes to people’s minds when they think about investing. To make your money work hard for you in a savings account, you’ll probably need to be able to lock it away for a set period of time so you can access the best interest rates. Fixed rate bonds usually offer the most competitive rates of all account types, with the longest terms typically paying the highest interest rates.

The good news is that this is a lower risk investment option, since £85,000 of your savings per person, per bank is protected by the FSCS (Financial Services Compensation Scheme). Because of this protection, it would be advisable to split your £100k, for example, by saving £50k with one bank and £50k with another, so that all your money is covered by the FSCS limit.

Stocks represent shares of ownership in a company. Companies usually sell shares of stocks to raise money when they want to generate capital to grow their business.

If you’re looking for places to invest £100k, buying stocks may enable you to increase your wealth and beat inflation, depending on how well the company you buy stocks in performs. However, if the company underperforms, you stand to lose some or all of your investment.

Read our investment guides for more information on how to get started.

Also known as P2P, peer-to-peer lending is an alternative way to invest or diversify your existing investment portfolio. This type of investment allows someone to accept a loan directly from someone else, rather than taking out a loan with a bank or building society.

When you lend an individual, or ‘peer’, money, you’ll earn interest and get your money back when they repay the loan. Lenders, like you as an individual investor, and borrowers, mainly small companies or other individuals, collaborate via online peer-to-peer companies, which keep overheads down.

The risk of you losing your money is mitigated by the P2P company splitting your money into smaller amounts, rather than loaning it all to one or two borrowers.

You can typically get a competitive rate of interest when you invest in peer-to-peer lending because the overheads are significantly smaller. There are no physical branches and fewer staff, for example.

The downside is that P2P lending is not currently covered by the FSCS, meaning there is more risk of losing your money should the borrower fail. However, thanks to the personal savings allowance, the first £1,000 of interest earned from P2P lending is tax-free for basic rate taxpayers. Meanwhile, higher rate taxpayers can earn up to £500 in tax-free income from a P2P platform. Certain P2P savings can also be held in some ISAs.

Equity is the amount of money that could be returned to a company’s shareholders once all assets are liquidated and debt is paid off.

Investing in equity can deliver a worthwhile stream of income, but it can also go terribly wrong if you don’t do your research or you make a risky move. It also carries more risk than some people are comfortable with.

If you’re looking for equity that pays regular income, a mixed basket of shares in different companies could be your best option as they often pay out dividends to shareholders. However, the stock market is unpredictable and subject to fluctuations, including financial crashes.

Bonds represent a company or government debt. When a company or government issues a bond, they are issuing debt and agreeing to pay interest on the money you’re “lending” them. Bonds typically pay out annual interest, repaying their debt at the same time. Because of this, bonds are often considered one of the safer types of investment, especially if you want to invest over a short term.

The different types of bonds are best described as a spectrum from most to least risky, starting at ‘gilts’, or government bonds, at the safer end, through to high-yield bonds from companies with low credit ratings at the much riskier end.

If you’re looking to be set for a certain period of time without access to your £100k, you could choose to invest in an annuity. An annuity will provide you with a guaranteed income stream but it will mean you give up your right to access your cash.

If you’re looking for the best way to invest £100k, it’s important to consider the following questions to ensure you’re fully prepared when the time comes to make your investment.

Decisions about personal finances and investments can be overwhelming, especially if you aren’t an experienced investor. If you’re inexperienced or new to investing, or if you’ve suddenly come into money, it could be a good idea to see a financial advisor.

A financial advisor will meet with you to determine what you want to achieve. Whether you’re looking to invest £50k, £100k or you have £10k to invest, a financial advisor can assess your situation and develop a comprehensive plan that aims to hit your financial goals. They can also typically invest your funds and set up accounts on your behalf, making the investment process less stressful for you.

You should always ensure that your financial advisor is an authorised individual with approved designations, such as a certified financial planner (CFP), chartered financial analyst (CFA) or a chartered financial consultant (ChFC).

The method for how you invest £100k will depend on the investment vehicle you choose. When it comes to stocks and shares, you might want to use a stockbroker, fund manager or robo-advisor to invest on your behalf (there’s more information about this in our guide to investing in the stock market).

If you would prefer to know your money is safe by depositing it into a competitive rate savings account, you can compare savings accounts online. You can compare a wide range of savings accounts from our partner banks in the Raisin UK marketplace. Simply log in or register for a Raisin UK account today to get started.

The question of whether to invest actively or passively is hotly contested by investing experts. While passive investing is the approach favoured by experienced investors, there are certain benefits that come with active investing, too, especially if you’re new to investing.

Active investing, as the name suggests, requires you to take a hands-on approach or a more ‘active’ role. This role will often be undertaken by a portfolio manager, who will try to beat the stock market using analysis and expertise that only they can really offer. A portfolio manager will usually have a team of investment experts and analysts who consider both qualitative and quantitative factors when trying to predict what the stock market is about to do.

Passive investing, on the other hand, exercises more of a ‘buy and hold’ mentality and a more long-term approach to investing.

The main difference between the two is that active investors are constantly trying to beat the market, whereas passive investors ride the stock market waves, keeping their eyes on rising stars and successful, established companies.

While investing is ultimately about growing your money, there is also the risk that it could shrink, which is something that many people, unsurprisingly, aren’t comfortable with. When it comes to investing an amount as large as £100k, it’s important to weigh up the risks carefully, and consider how much you’d be comfortable with potentially losing.

To determine your attitude to risk, there are free online questionnaires available which will recommend what investment vehicles you might want to look into, based on how much risk you’re willing to take. However, these should not be considered to be financial advice.

If you’re looking for the best, safest way to invest £100k, you might want to start by splitting it into smaller amounts and investing these ‘pockets’ of cash in different assets, increasing your security and reducing your risk of losing it all. You could build an investment portfolio by choosing to invest in a range of different assets – think of it as not ‘putting all your eggs in one basket’ when it comes to investing.

If you don’t like taking financial risks and you want to invest £100k safely, you could consider a cash ISA or fixed rate bonds. Both of these options keep your money protected, with fixed rate bonds typically offering a more competitive rate of interest and locking away your savings for a set period, normally between six months and five years, so you won’t be tempted to access your cash. At the end of your term, you can take what you’ve earned as income, or you could reinvest it in another fixed rate bond.

The best way to invest £100,000 with minimal risk is to split your money across two savings accounts to ensure it is all protected by the FSCS. One thing to look out for if you’re doing this is that FSCS protection only applies to each £85,000 per person, per bank, meaning that you need to know which banks are owned by which banking groups. For example, first direct and HSBC are both owned by HSBC UK Bank plc, meaning that only £85,000 would be protected, even if you had an account with both first direct and HSBC, as they are owned by the same parent company.

If you have a joint account, however, you will be protected up to £175,000 per person, per banking group, so opening a joint account can also mitigate your risk.

You can compare a range of competitive savings accounts from our UK partner banks in the Raisin UK marketplace. After you’ve made your decision, simply register for a Raisin UK Account to quickly and easily apply for free. Once you’ve been approved, all you need to do is make a deposit and watch your savings grow.

What’s in it for me?